By Jabulani Simplisio Chibaya

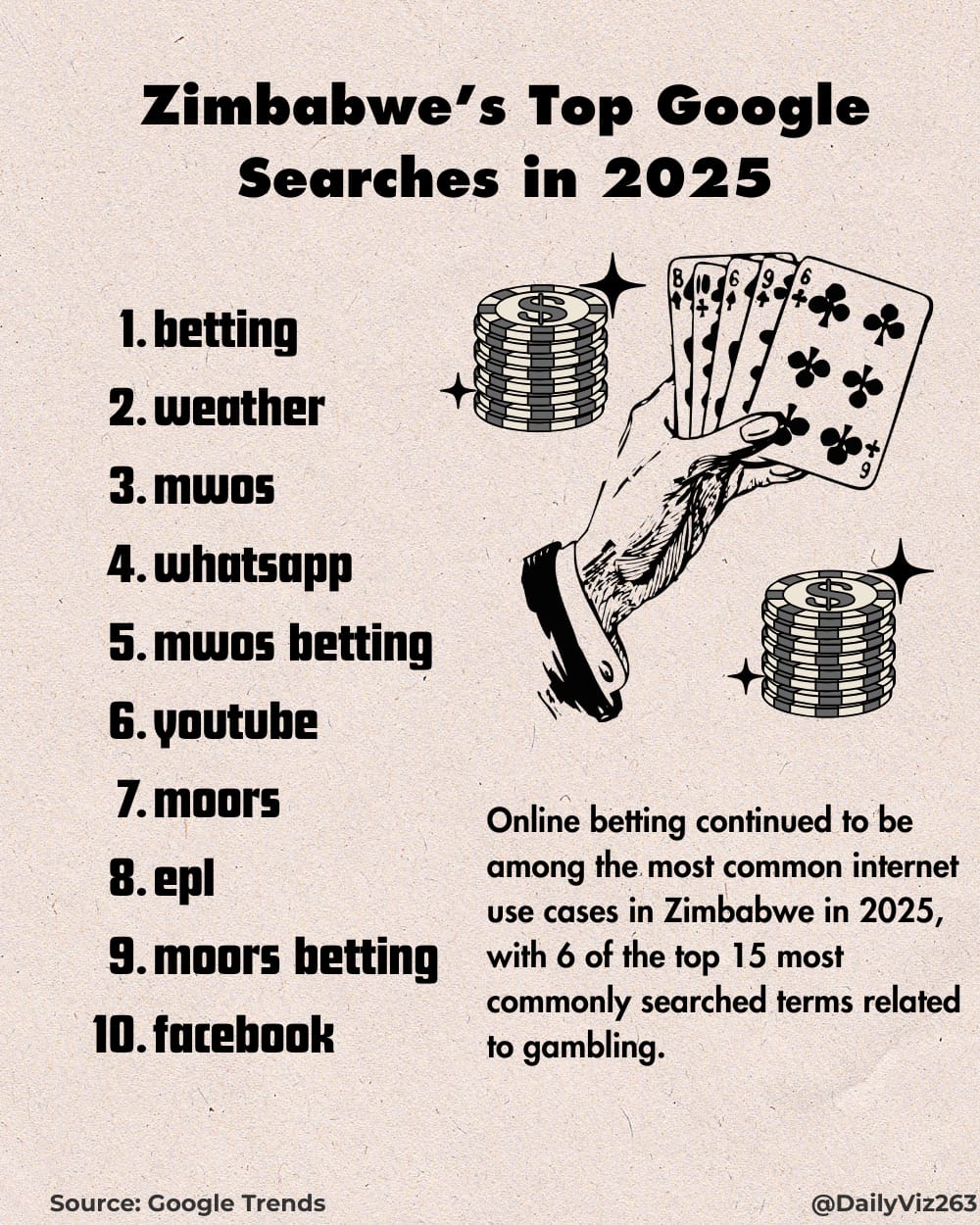

HARARE – ZIMBABWE’S top Google searches of 2025 read less like a tech usage report and more like a national mood board. Betting platforms, EPL, MWOS, Moors, WhatsApp, weather, YouTube — the list paints a picture of a society navigating risk, survival, connection, and hope through a smartphone screen. It’s humorous at first glance, but deeply revealing underneath. The pattern shows a population highly comfortable with risk — yet selectively so. We are bold with betting slips, cautious with balance sheets. Beneath the clicks lies an irony: Zimbabwe is not risk-averse — it is risk-misdirected.

Let’s decode what the searches quietly reveal about behaviour, opportunity gaps, and why gambling apps are winning attention that capital markets never even get to compete for.

🎯 The Nation Is Searching for Probability — Not Just Information

When betting ranks number one — and multiple betting platforms dominate the top searches — it signals more than entertainment. It reflects compressed risk behavior. In uncertain economies, people don’t stop taking risks — they shorten the cycle. Instead of waiting years for investment returns, many choose 90-minute matches with instant emotional and financial outcomes.

Betting has effectively become the unofficial micro-investment platform: low entry cost, fast feedback, simple interface, instant results.

The design matters. Three clicks, deposit, pick a match, potential return. Compare that with opening a brokerage account, understanding financial statements, and navigating settlement cycles. One is frictionless dopamine; the other is procedural patience.

Hidden signal: the appetite for risk is strong — but the on-ramps to formal investing are weak.

⚽ EPL + Betting = The Financialization of Football Fandom

The pairing of EPL searches with betting platforms shows that sport is no longer just watched — it is financially instrumented. Matches have become trading sessions in jerseys.

Fans now act like informal derivatives traders:

A yellow card = volatility spike

A last-minute goal = market shock

A VAR decision = regulatory intervention 😄

Attention has become capital. Data bundles in Harare are underwriting price discovery in Manchester. This is behavioural finance — just wearing football boots.

☁️ Weather at #2 — The Survival Economy Signal

Weather ranking near the top is quietly profound. It shows that despite digital adoption, livelihoods remain climate-linked. Farmers, traders, transporters, event planners, and vendors still anchor decisions on the sky.

This is not trivial search behaviour — it is economic planning. It shows a hybrid society: algorithmic feeds on one hand, rainfall forecasts on the other.

Digital habits are modern. Economic exposure is still agricultural.

💬 WhatsApp & Facebook — Not Apps, But Infrastructure

In Zimbabwe, WhatsApp and Facebook are not just social platforms — they are operating systems for daily life:

Marketplace

Customer service desk

Church bulletin

Family bank

Newsroom

Political rally

HR office

Community noticeboard

High search frequency suggests constant onboarding, device resets, new users entering the digital economy, and platform dependency. Platform literacy is still expanding — the market is far from saturated.

🎥 YouTube — The Open University of Hustle

YouTube’s presence signals self-education, DIY skills, music, repair knowledge, side-hustle learning, and informal certification. Many are learning trades, coding, marketing, mechanics, and finance from creators instead of classrooms.

Demand for skills is visible. Structured, local, credentialed digital education products are still lagging behind that demand.

🎲 The Great Irony: Acceptable Gambling vs Ignored Investing

Growing up, we are warned that gambling is dangerous, addictive, and destructive. Yet one of the largest and most socially accepted “gambling arenas” — the stock market — is rarely taught in schools. As Dr Alex Tawanda Magaisa once observed in his financial literacy writings, society condemns gambling broadly, yet overlooks that buying and selling shares is also a form of risk-taking under uncertainty — just structured, regulated, and economically productive.

There are even advanced forms like short selling — literally betting that a share price will fall — yet this is considered sophisticated finance, not reckless gambling.

Why then do sports bets attract millions while stock market participation remains thin?

Likely reasons:

Low financial literacy

Perception that markets are for the wealthy and elite

Complex onboarding processes

Poor product marketing

Lack of early education exposure

No gamified learning layer

Slow feedback cycles

As Magaisa noted through examples from Zimbabwe’s hyperinflation era: many pension contributors lost value through currency collapse, while shareholders in listed firms often preserved underlying ownership and recovered value over time. Knowledge created options. Ignorance removed them.

The difference was not luck — it was financial literacy.

🕳️ The Missing Searches Tell the Loudest Story

What’s absent from top searches is as revealing as what appears. You don’t see:

How to buy shares

Online investing Zimbabwe

Unit trusts

Retirement planning tools

Micro-savings platforms

SME finance apps

AI financial coaching

Digital skills certification

This absence signals product and education gaps — not lack of intelligence or curiosity. People cannot search for tools they were never taught exist.

🧠 Behavioural Insight: Instant Outcome Culture

Search behaviour suggests a broader cultural shift toward:

Fast cycles

Low friction

Immediate feedback

Mobile-first decisions

Entertainment + money hybrids

If it takes too long — attention drops.

If it’s complex — adoption drops.

If it’s boring — users drop.

Serious sectors — investing, insurance, pensions, banking, education — are now competing against live odds dashboards for attention.

That is the new behavioural benchmark.

😄 A Light Take on It

Zimbabwe’s search data basically says:

“Show me the weather, the odds, the match, the app — and don’t waste my data bundle.”

Some nations search for recipes.

Some search for philosophy.

Zimbabwe searches for probability with kickoff time.

🔍 Final Insight — Not Moral Failure, But Market Opportunity

It’s easy to moralize betting-heavy search trends. But analytically, this is not decay — it’s direction. It shows digital adoption, risk appetite, financial curiosity, and platform responsiveness — just channeled into the most accessible tools available.

Where risk appetite exists, investment culture can grow.

Where attention exists, education can be layered.

Where betting dominates, smarter financial products can be designed.

The opportunity is not to fight behaviour — but to upgrade the options.

From betting slips to balance sheets is not a moral journey — it’s a design, education, and access journey.

Jabulani Simplisio Chibaya is a Data and AI Consultant specializing in data science, artificial intelligence, blockchain, and cryptocurrency innovation. A seasoned conference speaker, he also writes on the intersection of technology, regulation, and economic development. Contact: Cell: +263 778 921 881, Email: simplisiochibaya22@gmail.com, LinkedIn: https://www.linkedin.com/in/jabulani-simplisio-chibaya

Discover more from Etimes

Subscribe to get the latest posts sent to your email.