By Jabulani Chibaya

HARARE – JANUARY 3 arrives quietly on the calendar, yet it carries a strange weight. The world, as it has since 2008, remains restless—wars flare and cool, economies strain under policy miscalculations, trust in institutions frays, and uncertainty feels permanent. It is only the third day of 2026, yet it already feels like we have lived through months of history.

January 3 is also Bitcoin’s birthday.

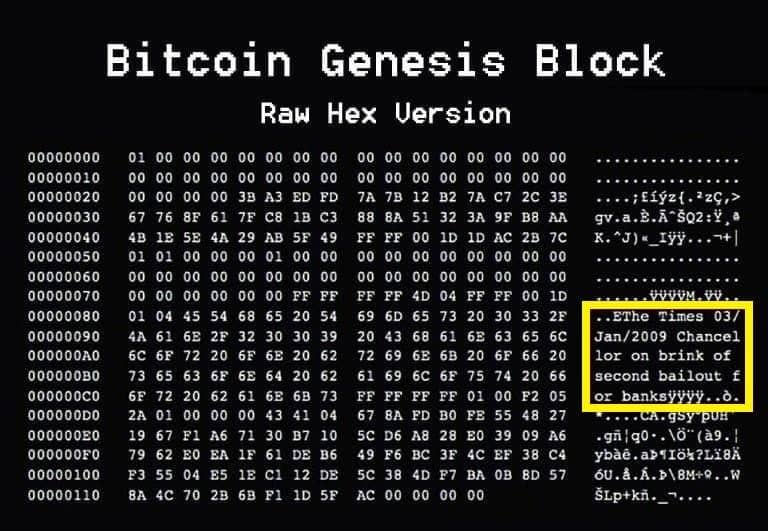

Seventeen years ago, on this very day in 2009, an anonymous individual—or group—known only as Satoshi Nakamoto mined the first block of the Bitcoin network. Embedded in that block was a message that sounded less like code and more like a warning:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

It was a timestamp, a protest, and a thesis statement rolled into one.

The Idea That Emerged From Crisis

To understand Bitcoin, one must return to the chaos of 2008. As banks collapsed and governments rushed to bail them out, a nine-page paper quietly appeared on October 31, 2008, titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” It proposed something radical: money without intermediaries, trust enforced not by institutions but by mathematics.

Few noticed at first. But slowly, the idea spread. By 2010, technology publications like CIO Magazine and PC Magazine were paying attention, especially as Bitcoin surfaced during the WikiLeaks funding blockade—proving it could function where traditional finance refused to.

What began as an experiment among cryptographers soon evolved into something larger.

From Curiosity to Infrastructure

Bitcoin introduced the world to what we now call blockchain—a term Satoshi never actually used. Blocks linked together, secured by cryptography, immutable and transparent. At its core were elegant but powerful tools: SHA-256 hashing, ECDSA digital signatures, and the secp256k1 elliptic curve. This wasn’t magic; it was applied mathematics.

And it worked.

Seventeen years later, Bitcoin has never been hacked at the protocol level. It has survived market crashes, political hostility, bans, ridicule, and cycles of hype and despair. Governments once dismissed it as “criminal money.” Today, the same governments use blockchain analytics for intelligence and law enforcement, acknowledging that Bitcoin is not anonymous but pseudonymous—traceable, auditable, and increasingly transparent.

The Ultimate Irony

Perhaps the greatest irony of Bitcoin’s journey is who now champions it.

The same institutions that once called it a scam—global asset managers like BlackRock and Vanguard—now offer Bitcoin-linked ETFs. Pension funds, insurers, and banks hold exposure. Major analytics firms such as Chainalysis, TRM Labs, and Elliptic publish detailed reports showing not only rising adoption, but also improving regulatory oversight.

Bitcoin has entered the room it was built to disrupt.

Countries like El Salvador and the Central African Republic have declared it legal tender. Others, wary of losing monetary control, race to launch central bank digital currencies—often with mixed results. Nigeria’s eNaira is a reminder that people don’t automatically trust digital money just because a central bank issues it.

Bitcoin is 17 years old.

January 3rd 2009

Satoshi Nakamoto mined the Genesis Block

This may be the most important event in modern human history.

Zimbabwe and the Question of Trust

In Zimbabwe, the Bitcoin conversation is no longer theoretical. Through Finance Act No. 7 of 2025, amendments to anti-money laundering laws and securities regulation now formally acknowledge digital assets. This came 17 years after the genesis block—a signal that the state, too, is adjusting to reality.

Zimbabwe’s struggle with currency stability, from hyperinflation to gold-backed experiments like ZiG, mirrors the very conditions that gave birth to Bitcoin in 2009. When trust in money erodes, people search for alternatives. Not perfect ones—just better ones.

Beyond Money

Bitcoin’s influence now stretches far beyond payments. Tokenized real estate, decentralized finance, cross-border settlements, strategic reserve debates, and even national defense theories—such as Jason Lowery’s arguments on Bitcoin as “software power”—have entered mainstream discourse.

Bitcoin has climbed into the top tier of global assets by market value, offering diversification in a world where traditional correlations increasingly fail.

Seventeen Years On

Seventeen years is a long time in technology. It is an eternity in finance. Bitcoin has grown from a whitepaper to an ecosystem, from skepticism to institutionalization. It has changed how we think about money, trust, and sovereignty—even for those who will never own a single satoshi.

The question is no longer whether Bitcoin will disappear. It is whether individuals, institutions, and nations truly understand it.

Do you?

Would you trust it with your savings? Your retirement? Your hedge against uncertainty?

The invitation remains the same as it was in 2009: read the whitepaper, study the system, question assumptions. Bitcoin does not ask for belief—it asks for understanding.

On January 3, the genesis block turns another year older. And once again, the world is reminded that some ideas, born in crisis, refuse to fade.

Jabulani Simplisio Chibaya is a Data and AI Consultant specializing in data science, artificial intelligence, blockchain, and cryptocurrency innovation. A seasoned conference speaker, he also writes on the intersection of technology, regulation, and economic development.

Contact:

Cell: +263 778 921 881

Email: simplisiochibaya22@gmail.com

LinkedIn: https://www.linkedin.com/in/jabulani-simplisio-chibaya

Discover more from Etimes

Subscribe to get the latest posts sent to your email.