By Jabulani Simplisio Chibaya

HARARE – ZIMBABWE’S capital markets have taken a significant step into the digital era following regulatory approval for the Financial Securities Exchange (FINSEC) to operate the country’s first Asset Tokenisation Market under the Securities and Exchange Commission of Zimbabwe (SECZim) regulatory sandbox. This development introduces a supervised, blockchain-enabled marketplace where real-world assets — starting with property — can be converted into tradable digital tokens and offered to investors under regulated conditions.

This is more than a technology story. It is a capital formation, liquidity, and inclusion story, one that could reshape how property, agriculture, mining, and other productive assets are financed and invested in Zimbabwe. Below is a detailed breakdown of what this means, how it works, what safeguards are in place, and which industries stand to benefit most.

What Is Asset Tokenisation — In Simple Terms

To understand tokenisation, start with the idea of ownership rights. Traditionally, a building has one or a few owners. A farm project is financed by a bank or a few investors. A mining claim is held privately or by a company. These assets are expensive to buy into and hard to sell quickly.

Asset tokenisation converts ownership rights or economic interests in such assets into digital tokens recorded on a blockchain system. Think of it like this: “A US$1 million property can be split into 1,000,000 digital tokens worth US$1 each. Investors can buy small portions instead of the whole asset.”

Each token represents a fractional ownership or income right, a claim on returns, and a regulated, recorded interest in a real asset. Unlike speculative cryptocurrencies, these tokens are backed by real, identifiable assets, issued within legal frameworks, traded on a regulated platform, and subject to compliance and disclosure rules.

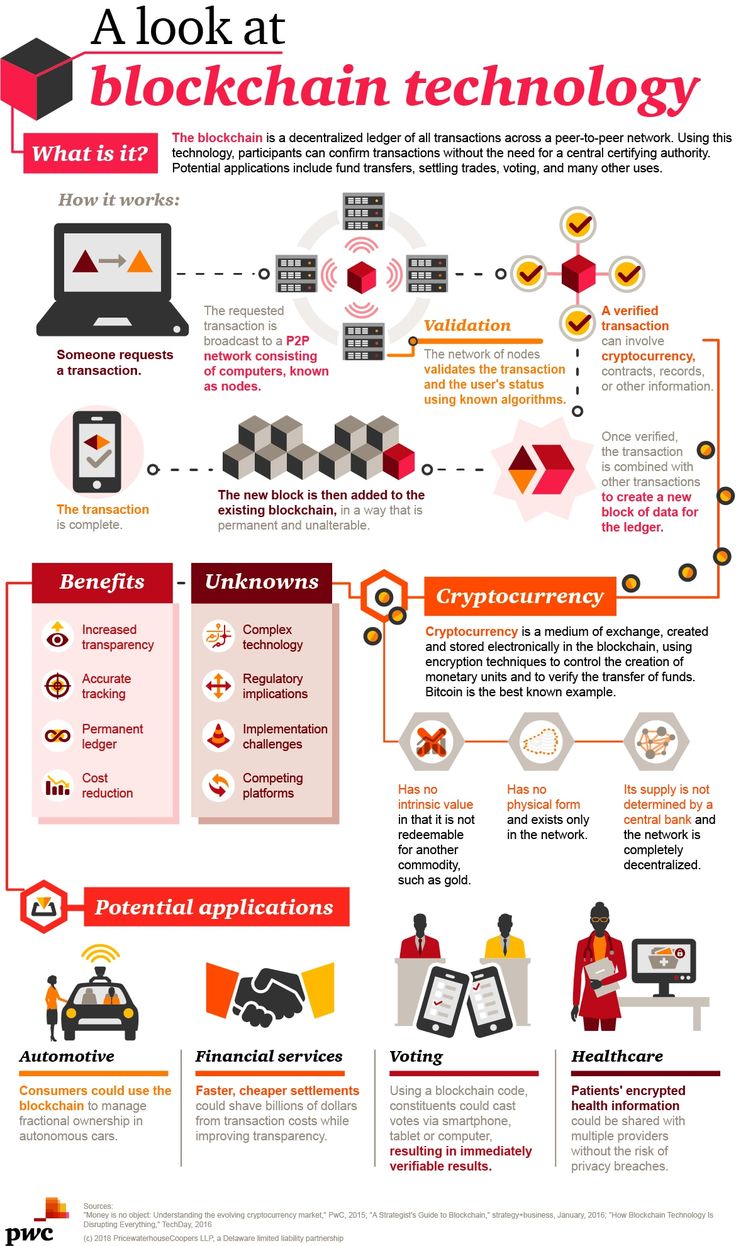

What Is Blockchain — And Why It Matters Here

Blockchain is a type of digital record-keeping system. Its key features are a shared ledger of transactions, tamper-resistant records, permanent audit trails, a transparent transaction history, and smart contracts (self-executing rules).

In the FINSEC model, blockchain is used to record token issuance, track ownership changes, automate compliance checks, enable secure settlement, and give regulators real-time visibility. This reduces record manipulation risk, settlement delays, ownership disputes, and administrative overhead.

What Exactly Has Been Approved

SECZim has granted FINSEC approval under its regulatory sandbox to operate a Tokenised Asset Market Infrastructure covering the full lifecycle of tokenised assets, including asset origination, due diligence, token issuance, trading, settlement, custody, and reporting.

The initial approved asset classes are income-generating property and development property, with scope to expand into livestock and other productive assets over time.

The Core Economic Impact: Turning Illiquid Assets into Liquid Investments

The Traditional Problem

Many Zimbabwean assets are capital intensive, hard to sell quickly, difficult to divide, expensive to access, and bank-financing dependent. Examples include commercial buildings, farming operations, mining equipment, agribusiness infrastructure, and property developments. These are illiquid assets — valuable but not easily tradable.

What Tokenisation Changes

Tokenisation introduces several key changes. It enables fractional ownership, allowing investors to buy small units instead of entire assets. It introduces secondary trading, meaning tokens can be traded on a regulated platform, which creates liquidity. It lowers entry costs so investors may participate with much smaller amounts instead of needing $50,000 or more. It allows for faster capital raising, as issuers can reach many investors simultaneously. Finally, it provides diaspora accessibility, allowing diaspora investors to participate digitally in regulated Zimbabwean assets.

FINSEC explicitly states the goal is to unlock liquidity, lower investment barriers, and broaden participation locally and in the diaspora.

Industries That Stand to Benefit Most

Real Estate & Property Development

This sector is a major winner. Use cases include commercial buildings, student housing, retail centres, industrial parks, and residential developments. Benefits are faster project funding, reduced reliance on bank loans, pre-selling fractional interests, better price discovery, and an increased investor pool. This could significantly boost the property market by unlocking stalled developments.

Agriculture & Agribusiness

Farmers and agribusiness operators can tokenise irrigation projects, livestock operations, processing facilities, and export crop projects. Benefits include seasonal capital raising, shared-risk funding models, investor-backed production cycles, pay-as-you-go insurance cover, and structured return models. This can deepen agricultural finance innovation.

Mining Sector

Mining projects can tokenise equipment pools, production streams, small-scale mining operations, and processing plants. Benefits include an alternative to informal funding, structured investor participation, traceable capital flows, and reduced financing bottlenecks. This is especially helpful for junior miners and small operators.

Banks

Banks can act as custodians, provide escrow services, structure token-backed products, finance tokenised assets, and create hybrid lending-token models. Tokenisation does not replace banks — it creates new product lines.

Insurance Companies

New insurance products will be needed for tokenised property, project performance risk, asset protection, and custody coverage. Insurance becomes embedded in token offerings — FINSEC notes insurance where applicable.

Startups & Fintech

Opportunities include token issuance platforms, compliance tech, digital identity, asset verification tech, smart contract auditing, valuation analytics, and investor dashboards. This can seed a tokenisation fintech ecosystem.

Diaspora Investors

Diasporans gain regulated access, smaller ticket sizes, transparent reporting, digital participation, and asset-backed exposure. This could redirect diaspora remittances into productive investment rather than consumption only.

Investor Protection Safeguards Built Into the Model

This is not a “free-for-all crypto market.” It is regulated. FINSEC’s approved framework includes due diligence, where each asset must be verified. It requires independent valuations, where assets must be professionally valued. There must be insurance cover where applicable, and trustee or custodian oversight provides third-party control structures.

The model enforces segregation of investor funds, keeping them separate from operator funds. It uses escrow-based settlement, where funds are only released when conditions are met. Transparent disclosures mean regular performance reporting is required. There are full KYC & AML controls for identity and anti-money laundering checks, along with investor suitability checks for risk-appropriate participation. Finally, there is regulatory sandbox supervision, meaning SECZim monitors the pilot closely before full rollout.

How This Feeds Into Zimbabwe Capital Markets

This development can deepen capital markets, expand product diversity, attract younger investors, bring digital participation, increase market liquidity, complement ZSE and VFEX structures, and channel savings into productive assets. It effectively creates a new digital asset class layer within regulated markets.

Skills That Will Be Needed Across the Value Chain

Legal & Compliance: Skills in digital asset law, smart contract law, custody frameworks, and securities compliance will be needed.

Finance & Investment: Expertise in token valuation models, fractional asset structuring, and risk modeling will be required.

Technology: There will be demand for blockchain engineering, smart contract development, cybersecurity, and platform architecture.

Property & Sector Specialists: Professionals skilled in token-ready asset packaging, digital reporting standards, and asset verification will be essential.

Advisory & Education: Roles in investor education, issuer advisory, and digital finance literacy will become increasingly important.

The Bigger Picture

This move signals regulatory openness to innovation, structured digital finance evolution, a bridge between real assets and digital markets, a pathway to democratise investment access, and a liquidity unlock for Zimbabwe’s asset base. If executed well, tokenisation can transform “expensive, slow, and illiquid assets into affordable, tradable, and transparent investments.” And that could be one of the most important capital markets developments Zimbabwe has seen in years.

Jabulani Simplisio Chibaya is a Data and AI Consultant specializing in data science, artificial intelligence, blockchain, and cryptocurrency innovation. A seasoned conference speaker, he also writes on the intersection of technology, regulation, and economic development. Contact: Cell: +263 778 921 881, Email: simplisiochibaya22@gmail.com, LinkedIn: https://www.linkedin.com/in/jabulani-simplisio-chibaya

Discover more from Etimes

Subscribe to get the latest posts sent to your email.