By ETimes

Financial Performance Highlights

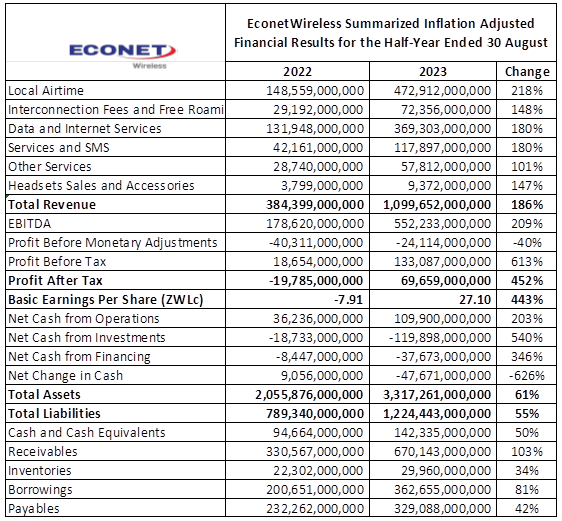

- Telecommunications giant Econet Wireless rebounded back to profitability with a ZWL$69.7 billion inflation adjusted after tax profit. This was supported by monetary gains of ZWL$157.2 billion after the group incurred hefty exchange losses of ZWL$375.4 billion.

- The group’s Earnings before Interest Tax Depreciation and Amortization (EBITDA) climbed 209% to ZWL$552.2 billion.

- Total revenue increased by 186% to ZWL$1.1 trillion, with earnings from local airtime sales contributing ZWL$472.9 billion after a 218% increase and data and internet services returning sales of ZWL$369.3 billion after a 180% rise.

- Noting that local voice and data tariffs remain at discounts of 58% and 88% respectively to the region, the group highlighted viable pricing as a key factor for the continued growth and sustainably of the telecommunications industry.

- The groups operations generated net cash of ZWL$109.9 billion, which partially financed investment expenditures of ZWL$119.9 billion and financing outflows of ZWL$37.7 billion.

- According to the group capital investments for the period amounted to 24% of revenue as it modernized 252 base stations in Q1 and 439 in Q2 covering Harare and Bulawayo. The investments are expected to improve network performance, capacity and coverage.

- Total assets stood at ZWL$3.3 trillion at the end of the period, with cash holdings of ZWL$142.3 billion, receivables of ZWL$670 billion and inventories of ZWL$29 billion. Total liabilities reached ZWL$1.2 trillion, with total borrowings of ZWL$363 billion and payables of ZWL$329 billion.

- Going forward, the group outlined its strategic focus on transforming the business to a fully fledged digital service provider and modernizing network infrastructure and broadening service offerings. In addition, the group will look to leverage artificial intelligence and process automation to improve operational efficiencies and customer service delivery.

- The group did not declare a dividend.

Commentary and Analysis

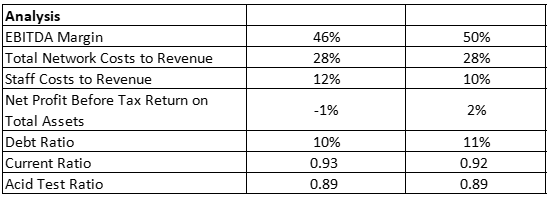

The figures above point to stability, with most of the analysis metrics relatively static. So, the main difference maker seems to have been the increased foreign currency takings on airtime and data sales, which moderated exchange related losses, leading to the groups relatively modest profit – by Econet standards. Having undergone a somewhat depressed few years, the performance points to the group turning a corner. More so with the resolution of the debenture debacle in the post reporting period, with the successfully concluded rights issue effectively retiring the outstanding debts. And with the increasing scale of dollarization, the outlook is a lot more positive for the Econet Wireless group. With the increased internal capacity the group looks well set to further consolidate its dominance of Zimbabwe’s telecommunications and digital spaces.

On the ZSE, since the start of 2023, the Econet share has gained 617% in nominal terms and lost 14% in USD implied terms. The share is currently trading at Price to Book ratio of 0.8x – Harare