By Yona Banda

Financial Performance Highlights

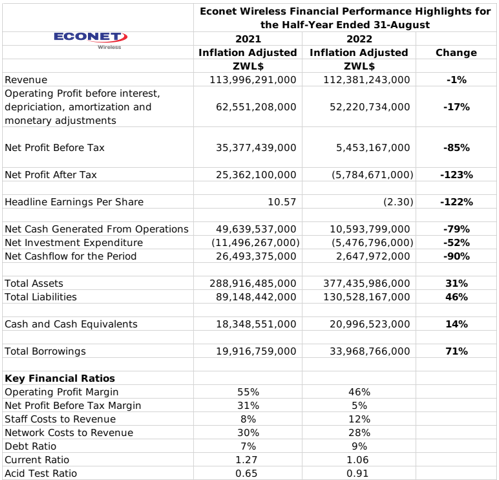

Listed telecommunications group Econet Wireless reported an after tax loss of ZWL$5.8 billion for its half-year ended 31 August 2022. The performance was an inflation adjusted decline of 123% from the 2021 comparative period. Operating profits fell by 17% to ZWL$52.2 billion.

The group attributed the declining profitability to sub-optimal tariffs and cost pressures under the hyperinflationary environment. The group also noted the significant impact of exchange losses of ZWL$43.7 billion that arose from the group’s foreign currency denominated liabilities.

Total revenue for the period stood at ZWL$112.4 billion, which was a 1% decline in inflation adjusted terms from the comparative period.

The group’s operations generated net cashflows of ZWL$10.6 billion, which was a 79% decline from the comparative period. Net investment expenditure declined by 52% to ZWL$5.5 billion. According to the group, capital expenditure during the period was less than 5% of total revenue, and less than the 15% average of peer regional telecommunications operators. This was attributed to restricted access to forex, with the group noting the adverse impact of low capital investment on network coverage.

The group’s total assets stood at ZWL$377.4 billion, with cash holdings of ZWL$21 billion. Total liabilities stood at ZWL$130.5 billion, with borrowings of ZWL$34 billion.

Local airtime remained the group’s largest source of revenue at ZWL$43.4 billion, rising by 3% during the period. Data and internet sales followed at ZWL$38.6 billion, after a 2% decline. Revenue from value added service and SMSs had the largest decline, falling by 20% to ZWL$12.3 billion.

Going forward, the group highlighted the need to access foreign currency to meet its aim to exploit 5G network enabled opportunities.

Going forward, the group highlighted the need to access foreign currency to meet its aim to exploit 5G network enabled opportunities.

The group did not declare a dividend.

Commentary and Analysis

The financial performance largely falls in line with expectations, given the sharp inflation experienced in the first half of 2022 against the group’s restricted control of service prices. One possible upside is that the operating profit margin, staff costs to revenue ratio, and network costs to revenue ratio suggest the group fared reasonably in its efforts to contain costs. Although those efforts may well be a contributing factor to declining service quality – which would matter in a much more competitive environment.

The group was also expected to incur some hefty losses from its foreign currency debts related to its outstanding debentures. The unsecured debentures are slated to mature at the end of April 2023, with the holders due US$56.6 million. The liability has expectedly been a prominent issue in recent years. In 2021 the group offered early redemptions for debenture holders at the interbank rate, an offer which 22.46% of the holders took up. Prior to that, in 2018, a proposal to convert the debentures into ordinary shares on a 1:1 basis was shelved after some shareholder dissent. Now, with the group highlighting foreign currency access as a major issue, it will be interesting to see how the story concludes.

During the half-year, the group’s operations generated just about enough gross cash flow to cover the debenture liability in ZWL terms (at the interbank rate), while cash holdings at the end of the period only covered 71% of the liability. A less inflationary operating environment in the second half-year would be expected to improve Econet’s repayment capacity. Nevertheless, barring significant developments in the macroeconomic environment, the group’s ability to repay the liability in hard-currency would still be questionable. Payment in local currency at the official rate seems to be an unpopular option for the remaining debenture holders. New foreign currency credit lines could be arranged to meet the maturing liabilities, but they would likely come with steep interest rates and repayment terms. It could also have some severe negative consequences down the line if the local economic outlook does not improve. At a time, the group’s major shareholder was reported to hold a significant share of the debentures. Taking all these things into consideration, there is a good chance that the swap proposal may need to be revisited.

On the ZSE, since the start of 2022, the Econet Wireless share has lost 18% in nominal terms and 86% in implied USD terms. One of the arguments brought against the swap proposal was the wide mismatch between the debenture value and the Econet Wireless share price at the time of USc30. Evidently, the share price has fallen off significantly since then. At the current interbank implied USD price of USc10.81 against the debenture redemption price of USc6.252, the swap proposal still appears favorable for the debenture holders. The attraction declines at a parallel rate implied valuation, but would still be viable at USc7.2. A continuation of the shares’ weak performance stands to erode the short-term benefit to the debenture holders from a swap deal. But, at a price to book ratio below 1x, it could be a bargain in the long-run – Harare