By ETimes

Financial Performance Highlights

- Zimplow reported an inflation adjusted net loss after tax of ZWL1.3 billion for its financial year ended 31 December 2022 which was a 186% decline from the previous year.

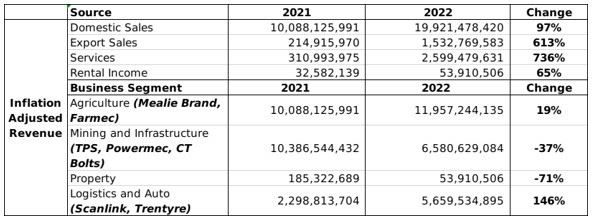

- Total revenues increased marginally, rising 6% to ZWL$24.1 billion while gross profits increased by 25% to ZWL$10.6 billion. The downturn in the bottom line was largely due to a losses of ZWL$7.4 billion incurred due to the discontinuation of the Barzem segment. Consequently, the operating profits declined by 103% to a loss of ZWL$106 million.

- Revenue from domestic sales was down 5% during the year to ZWL$19.9 billion while export sales increased by 107% to ZWL$1.5 billion. The group noted depressed local demand for agricultural equipment due to the drought experienced in the second-half of the 2020/21 agric season and the tight liquidity environment. The group also noted its failure to exploit the upturn in mining and construction activity due to the termination of the Caterpillar distributorship by Barloworld.

- The rising export revenues were driven by the Mealie Brand operation, which saw export volumes rise by 36% versus a 16% decline in the domestic market. The Farmec operation saw tractor volumes fall by 15% as customer preferences switched to high horsepower ranges, while tractor implement sales volumes increased by 4%.

- Following the discontinuation of Barzem, the group has transitioned to Tractive Power Solutions (TPS). Affiliations and accreditations from new suppliers have been acquired and the new operation is poised to provide a comprehensive service offering. The Powermec division saw increased demand for alternative power, with genset sales rising by 16%, service hours 44% and solar plant installations 114%. CT Bolts saw its volumes remain stable, but pressure on margins saw operating profits decline by 14%.

- The Scanlink business saw truck and bus volumes rise by 88% and 300% respectively driven by an improved supply chain. Parts and service hours sold declined by 11% and 5% respectively. The group expressed optimism on the future performance of the unit with the supply chain improvement and internal reorganization. The Trentyre unit saw Good Year tyre sales volumes rise by 2% despite internal reorganization and supply gaps. Production of retreads increased by 40% due to the optimization of the retread factory.

- The groups operations generated a net cash flow deficit of ZWL3.1 billion, which saw net investment expenditures decrease by 56% to ZWL$133.2 million.

- Total assets increased by 16% to ZWL$32 billion. With cash holdings falling by 66% to ZWL$1.6 billion and inventories falling by 2% to ZWL$9.1 billion, the growth was largely driven by upward revaluations to the groups PPE.

- Total liabilities declined by 1% to ZWL$12.1 billion, with borrowings rising by 50% to ZWL$793k and payables falling by 25% to ZWL$6.3 billion.

- Going forward, the group is aiming to extract efficiencies and synergies, and expects to realize significant cost savings in the new financial year. The product range at Mealie brand has been expanded to accommodate for small-scale mechanization equipment. Renovations of the property at 65 Birmingham Road projected to be worth US$195,000, are expected to be completed by end of Q2 of FY23. The property will be converted from an investment property to be owner occupied where the new business’s, Tractive Power Solutions and Valmec, will operate from.

- The group opted against declaring a dividend in consideration of the plans to reorganize the Mining and Infrastructure cluster.

Commentary and Analysis

In implied US dollar terms, revenue was down in the groups key segments, with Mining and Infrastructure taking a big hit from the closure of the Barzem unit. The weak revenue growth and the loss provisions from the closure saw the group swing into loss, and resulted in a negative net operating cash flow. On a positive, the groups debt remained relatively low as it leaned on its cash holdings. Going forward, with the ongoing restructuring and the probable increase in working capital needs, the group will likely need to raise some medium term debt in FY23. Assuming the group is able to access the necessary capital, sales from the mining and infrastructure segment will be expected to improve as the TPS unit commences operations. Increased government infrastructure spending offers some upside while downside risk is presented by the more subdued outlook for mining commodity prices in 2023. The governments dealings with Belarusian agricultural equipment manufacturers could also be a concerning development for the groups business. Although, the increased focus on small to medium scale could be another avenue to capture some upside from agriculture related government expenditure. The revenue growth in the logistics and auto segment was driven by the fulfillment of long-standing orders, which points to a more subdued out-turn FY23. So, the FY23 outlook is weakly positive for Zimplow, with moderate real revenue growth, monetary gains and the absence of heavy once-off costs likely to see profits significantly improve – although increased financing costs are likely to dampen the bottom-line growth. Additionally, the groups gross and operating profit margins are likely to retreat as the sales composition normalizes.

On the ZSE, since the start of 2023, the Zimplow share has gained 457% in nominal terms and 201% in implied USD terms. The share is currently trading at a Price to Book ratio of 0.9x – Harare