By ETimes

Financial Performance Highlights

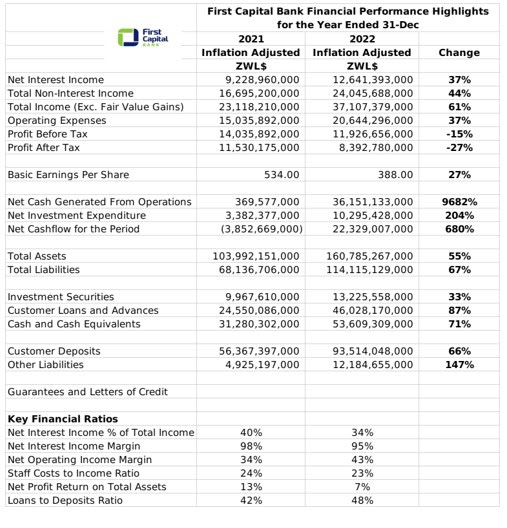

- First Capital Bank reported an inflation adjusted after tax profit of ZWL$8.4 billion for its financial year ended 31 December 2022. The performance was a 27% decline from the 2021 return which was attributed to a 237% rise in net monetary losses to ZWL$6.5 billion. The loss was moderately offset by a ZWL$3.1 billion share of earnings from a joint venture related to a hospitality asset.

- Total income was 42% higher at ZWL$36.7 billion, with net interest income rising by 37% to ZWL$12.6 billion and non-interest income rising by 44% to ZWL$24 billion. Among the non-interest income lines, fees and commissions made the highest contribution at ZWL$12.2 billion while trading and foreign exchange trading income registered the highest growth at 267% to ZWL$11.5 billion. Operating expenses increased by 37% to ZWL$20.6 billion.

- Customer loans and advances increased by 87% to ZWL$46 billion. Corporate and investment banking clients made up 59% of the loan book while retail and business banking clients took up 26% and 5% respectively. Off-balance sheet exposures stood at ZWL$4 billion.

- Customer deposits increased by 66% to ZWL$93.5 billion with the growth concentrated in physical persons which grew by 96% to ZWL$22.4 billion, and light and heavy industry which rose by 254% to ZWL$21 billion. Customers in trade and services made up 28% of the deposits, physical persons made up 25%, and light and heavy industry made up 22%.

- Net cash flows from operations grew to ZWL$36.1 billion, investment expenditures reached ZWL$10.3 billion and the net cash flow of the period was 680% higher at ZWL$22.4 billion.

- Total assets increased by 55% to ZWL$160.8 billion, with cash holdings of ZWL$53.6 billion and investment securities of ZWL$13.2 billion.

- Total liabilities increased by 67% ZWL$114 billion. The bank updated that creditlines from European Investment Bank (EUR12.5mln) and AfreximBank (US$20mln) were negotiated and in varying stages of disbursement.

- The bank’s total capital increased by 30% to US$61 million whilst the closing capital adequacy ratio was 34%. The bank noted that its capital position represented substantial headroom to underwrite new business.

- In the boardroom, Mr. Munyaradzi Kavhu was appointed as the Chief Operating Officer for the Bank with effect from 9 January 2023. Mr. Lovemore Mangenda was appointed as Head of Compliance and Mrs Sarudzai Binha was appointed Head of Company Secretariat and Legal Services respectively

- The group declared a final dividend of ZWLc 127 per share, bringing the total dividend for the year ended 31 December 2022 to ZWLc171 per share.

Commentary and Analysis

Growth in income related to the group’s core banking operations (interest + fees and commissions) at 42% was only marginally higher than the growth in operating expenditures at 37%. The growth in foreign exchange related income drove the 61% growth in total income, but this was ultimately offset by the monetary losses incurred during the year – leading to the group’s declined profits. Stronger growth in interest income would have been expected with the prevailing interest rates. The credit lines with EIB and Afrexim would be expected to support growth in interest income in FY23, although this might be constrained by increased credit risk from the volatile economic and political environment.

It is interesting that the real value of the group’s total deposits declined from US$156 million to US$138 million during the year. Despite the decline there was marginal growth in the group’s share of the banking sector deposits, from 3.8% to 4.4%. However, the overall trend has been a decline in market share since 2017, which coincides with the banking operation fully becoming part of the First Capital Group following the exit of Barclays from Africa. It could be the reduced appeal of a bank tied to a regional outfit versus a large international group. Weak regional economic integration and trade ties are structural challenges that African banking groups have had to contend with. The First Capital Group has a geographic focus on the SADC community countries, which have relatively low levels of regional integration. There is also the general trend towards consolidation in the banking sector, with decreasing growth space for the lower tier banks. These factors point to the need for First Capital to establish a growth anchor market segment in the banking sector and distinguish itself as the choice option in the segment.

On the ZSE, since the start of 2023, the FCA share has gained 108% in nominal terms and 42% in implied US dollar terms. The share is currently trading at a price to book ratio of 0.9x, which is noticeably higher than peer mid-tier banking stock NMBZ Holdings at 0.4x – Harare