By ETimes

Financial Performance Highlights

- VFEX listed First Capital Bank reported a half-year profit after tax of US$4.3 million which represented a 232% rise from the 2022 comparative. The group’s performance was weighted on by a loss of US$3.8 million stemming from a joint venture investment.

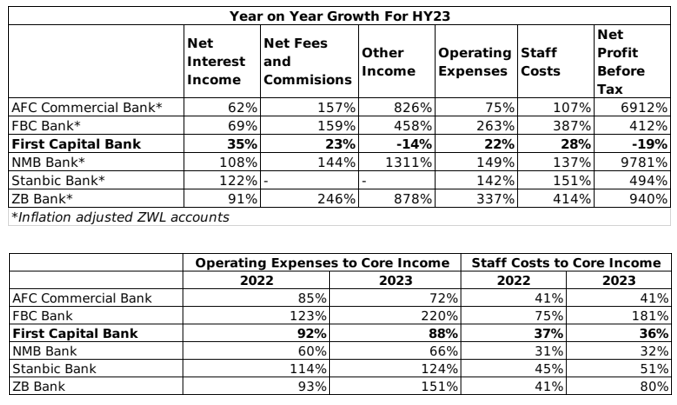

- Rising income was supported by 23% growth in net fees and commissions to US$11.5 million, which the group attributed to several initiatives gears to increase USD transaction services for customers. The group also expanded to offering vehicle insurance and licensing services to its customers. Net interest income increased by 35% to US$11.6 million while other income declined by 14% to US$9 million.

- The group’s operations generated a cash flow deficit of US$26.8 million, which saw an overall decline of US$24.5 million to its cash position.

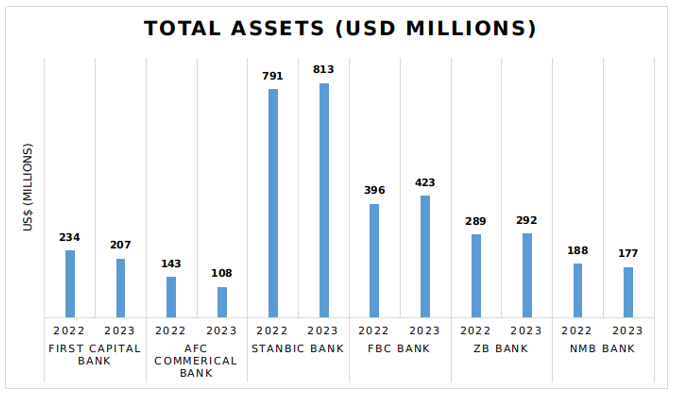

- Total assets declined by 12% to US$233.94 million, with cash holdings of US$53.5 million, and investment securities of US$16.1 million. Loans and advances contributed US$79.5 million after increasing by 21%.

- Total liabilities declined by 13% to US$144.5 million, with deposits accounting for US$122 million after declining by 11%. Trade and services accounted for 37% of the groups customer deposits while physical persons made up 25%, and light and heavy industry 15%. The group reported that its EUR12.5 million facility with the European Investment Bank was nearly fully drawn. It added that a further US$20 million credit line from Afreximbank has been mobilized and is now at the drawdown stage.

- The group noted the negative impact of sharp devaluation of the ZWL on the banks US$ denominated core capital which declined by 2% to US$48 million. Despite that, the group maintained that its capital adequacy ratio remained strong at 37%, and its liquidity position remained secure at 49%.

- The group declared an interim dividend of US$0.14 cents per share.

Commentary and Analysis

The sizeable growth of peer banks reporting in ZWL denominated accounts makes it difficult to put First Capital Banks financial results into context. On the face of it, First Capital’s results look extremely subdued. However, there is probably a strong point to be made about the usefulness and credibility of inflation adjusted ZWL accounting at this stage. Nevertheless, losses from the groups joint venture investment of US$3.8 million were the main contributor to the decline in profits (before tax). Although, analysis suggests that in terms of cost efficiency, First Capital compares reasonably – with fair value gains and unrealized exchange gains dominating the income mix of its competitors.

In terms of the balance sheet, First Capital took one of the larger hits on total assets value during the period. It is an outcome that reflects the contradiction between reporting in USD whilst a significant share of the group’s assets is ZWL denominated. It highlights the need going forward to significantly ramp up First Capital’s hard currency business and customer base. The groups apparent strategic focus on serving the SME market makes sense as the large banks consolidate their shares of the retail/consumer banking market. The big question is if it will be enough as demonstrated by fellow SME focused mid-tier bank NMB’s diversification into FinTech and property development. The groups foray into hospitality currently looks like a bit of an awkward fit and keeps the spotlight on core operations. Notably, First Capital has the unique advantage of having a presence across most of the SADC region. There is arguably scope for First Capital to tap into the growing regional interest in strengthening trade ties and supporting SME development.

The First Capital share migrated to from the ZSE to VFEX during the course of 2023. It has an implied nominal return of 603% and an implied real return of 0.06%. It is currently trading at price to book ratio of 0.7x – Harare

Advertisement