By ETimes

Financial Performance Highlights

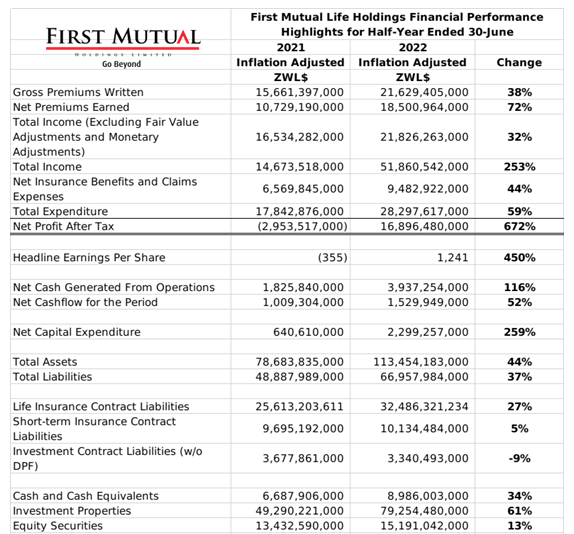

- Listed insurance group First Mutual Holdings announced a ZWL$16.9 billion for its half year period ended 30 June 2022.

- In inflation adjusted terms, the groups Gross Premiums Written increased by 38% to ZWL$21.6 billion, with Net Premiums Earned rising by 72% to ZWL$18.5 billion. The growth was attributed to organic growth on the existing portfolio and revaluation of policies in line with inflation as well as a rise in USD policies.

- Total income increased by 253% to ZWL$51.9 billion. The sharp rise was in large part due to fair value gains of ZWL$30 billion in the group’s investment property holdings. Excluding the fair value and monetary gains, total income increased by 32% to ZWL$21.9 billion.

- Total expenditures increased by 59% to ZWL$29.3 billion, after net insurance claims and benefits expanses rose by 44% to ZWL$9.5 billion.

- The group’s operations generated net cash flows of ZWL$4 billion, which allowed for net investment expenditures of ZWL$2.3 billion.

- At the end of the period, the group’s total assets stood at ZWL$113 billion and total liabilities reached ZWL$67 billion. The groups assets comprised of Investment property holdings of ZWL$79 billion, equity securities of ZWL$15 billion and cash holdings of ZWL$9 billion. Commenting on the negative impact of the recent bearish turn on the ZSE, the group noted that it will continuously assess the market conditions and will aim to diversify its investments towards real assets.

- The groups life insurance liabilities stood at ZWL$32 billion from ZWL$26 billion at the start of period and short term insurance contracts were at ZWL$10 billion from ZWL$9.7 billion.

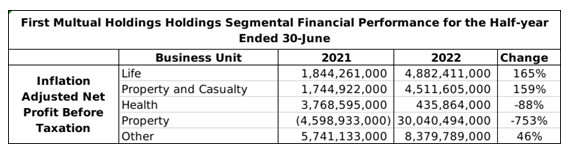

- The life insurance segment saw its profits climb 165% to ZWL$4.9 billion. GPW in the First Mutual Life operation increased by 51% to ZWL$3 billion, while the claims ratio increased to 25% from 20%.

- The health insurance segment saw its profits decline by 88% to ZWL$435 million. Despite that, the group reported GPW for the First Mutual Health operation at ZWL$8 billion after a 40% rise. This was attributed to growth in foreign currency denominated policies. The claims ratio for the segment declined to 77.17% and membership growth was relatively static at 116,516. The slow growth was attributed to the declining disposable incomes, with the group pledging to invest in expanding its health care and pharmaceutical facilities to improve affordability.

- The short term insurance segment registered profit growth of 159% to ZWL$4.5 billion. The NicozDiamond operation saw its GPW rise by 27% to ZWL$6 billion, off the back of customer growth and increased foreign currency denominated policies. The claims ratio increased from 40% to 42%, which was attributed to a change in the mix of policy classes and easing of lockdown restrictions. Diamond Seguros – the groups Mozambique operation saw its GPW rise by 47% to ZWL$464 million.

- In the reinsurance operations, the First Mutual Reinsurance Company had a 49% rise in GPW to ZWL$2 billion due to increased demand for USD policies. The operation saw its claims ratio rise from 35% to 62% due to increased economic activity and higher claims in agriculture. The Botswana operation FMRE Property and Casualty had a 20% rise in GPW to ZWL$3 billion. The group reported improved business and confidence in the business following the BWP40 million recapitalization.

- The groups wealth management operation saw its investment management fees increased by 55% to ZWL$165 million. Funds under management increased by 43% due to increased support from third party pension funds.

- Going forward, the group will aim to continue pursuing avenues to diversify its business portfolio through strategies such as expanding the regional footprint and pursuing strategic partnerships.

- The group declared an interim dividend of ZWL$80 million and US$125k.

Commentary and Analysis

Fair value gains from the group’s property operation were a significant contributor to the sizeable profit growth. It is observed that growth in income (excluding adjustments) at 32% was outpaced by growth in total expenditures at 59%, and netting the figures off returned a deficit of ZWL$6.5 billion. Regardless, the group’s operations generated a net cash flow of ZWL$3 billion, which allowed it to internally finance its investment activities. The rising scale of business in the group’s regional operations was highlighted as a positive, although it was not disclosed if the operations were profitable. The growth bodes well going forward, along with moderate optimism on the economic prospects of Zambia, Mozambique and Botswana. In the domestic market, the group’s market position is relatively stable, with the short term reinsurance business benefiting from its capacity to meet the rising demand for USD policies. Given the depressed outlook for the domestic economy, and the relative maturity of the domestic insurance industry, there is currently a significant emphasis on the success of the regional business.

Beyond financial concerns, there is some behind the scenes intrigue, with the apparent acquisition of a controlling stake in First Mutual Holdings by CBZ Holdings. With seemingly no official communication or acknowledgement from FMH, it will be interesting to see how the two entities will combine. The CBZ Holdings CEO was quoted in the press saying he expects FMH to eventually be delisted and have its operations absorbed. It will certainly be sad to see an iconic brand like First Mutual disappear, and the integration process promises to be complex considering that CBZ Holdings is also allegedly eyeing ZB as another acquisition target. Assuming it all works out, the resultant entity will have a significant domestic and regional footprint in the insurance sector – Harare