By ETimes

Financial Performance Highlights

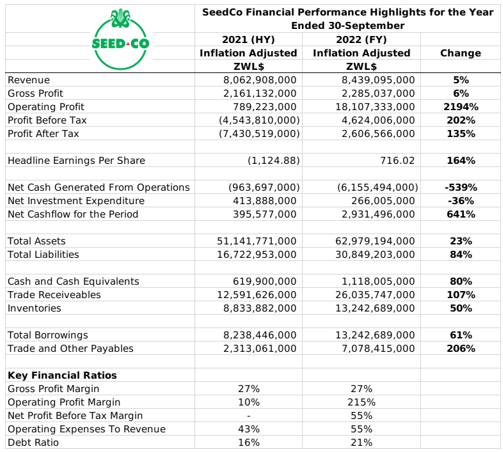

- SeedCo limited reported a ZWL$2.6 billion inflation adjusted after tax profit for its half-year ended 30 September 2022 from a loss of ZWL$7.4 billion in the 2021 comparative. The group incurred monetary losses of ZWL$8.1 billion which were overcome by value gains stemming from US dollar denominated seed grower receivables.

- Gross profits increased by 6% to ZWL$2.3 billion, with the margin remaining stable at 27% as the group continuously aligned its prices with inflation and exchange rate developments. However, the group noted inflationary pressures on its operating costs, with the operating expenses to revenue ratio increasing from 43% to 55%.

- Revenue growth was subdued at 5% to ZWL$8.4 billion during the half-year. According to the group, winter sales were down by 8% due to the absence of repeat export sales while maize seed volumes declined by 45%. The decline in maize seed sales was attributed to delays in the rollout of government programmes and, depressed demand due to the tight liquidity conditions.

- The group’s SeedCo International subsidiary saw its losses widen to ZWL$1.2 billion during the period. This was attributed to subdued early sales in the Malawi and Nigeria operations due to product unavailability and drought in East Africa.

- The group’s operating cash flow deficit widened by 539% to ZWL$6.2 billion while net investment expenditures declined by 36% to ZWL$266 million.

- Total assets stood at ZWL$63 billion, with cash holdings of ZWL1.2 billion, inventories of ZWL$13.2 billion and receivables of ZWL$26.1 billion. The groups total liabilities stood at ZWL$30.9 billion, with borrowings of ZWL$13.2 billion and payables of ZWL$7 billion.

- The group explained the increase in short-term borrowings as aligned with the business borrowing cycle with funds required for the intake and processing of seed. The group also noted the inflation induced increase in working capital demands, as well as the need to fund delayed settlements of government related debtors.

- Looking ahead, SeedCo is still taking deliveries of maize seed, and currently holds 15,500MTs of maize seed across all varieties. It expects to have adequate stocks to meet demand for the summer planting season in both its local and subsidiary operations. The group will look to enhance hard currency local sales and exploit opportunities in regional markets. The group also reported pleasing progress in its research and development projects related to rice and potato seeds.

- No dividend was declared for the period.

Commentary and Analysis

It’s a set of financial statements that raises some concern. The exchange gains on the USD valued receivables tied to seed deliveries appear to have contributed significantly to the group’s profits. It is set up for the second half-year to crystalize the gains, but there is the downside risk of depressed demand as highlighted by the decline in early seed sales. There is also inflationary pressure on the group’s operations. The current sociopolitical conditions stand to limit the group’s capacity to push through price increases on key seed variants. On the upside, leading into an election year, the government will be aiming for a strong agricultural season. However, late payment has been a persistent issue in the group’s dealings with the government, and the current tight liquidity regime does not bode well for timely future settlements. A significant portion of the SeedCos current borrowings are likely foreign currency denominated – a delay in payment coupled with more ZWL devaluation could see the group incur more hefty exchange losses.

On the ZSE, since the start of 2022 the SeedCo share has shed 22% of its value in nominal terms and lost 87% in implied US dollar terms. Over the year the share has peaked at ZWLc25,001.81 and bottomed out at ZWLc5,700. It is currently trading at a price to book ratio of 0.5x – Harare