By ETimes

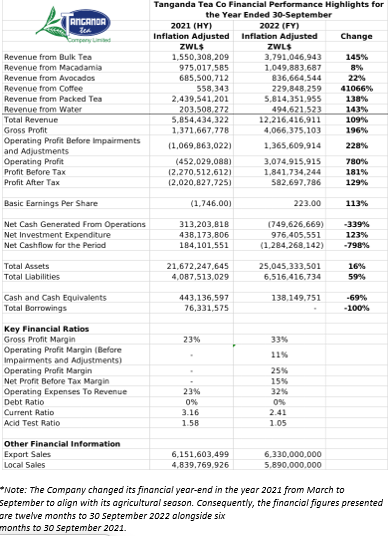

*Note: The Company changed its financial year-end in the year 2021 from March to September to align with its agricultural season. Consequently, the financial figures presented are twelve months to 30 September 2022 alongside six months to 30 September 2021.

Financial Performance Highlights

- The Tanganda Tea Company announced an inflation adjusted Net Profit After Tax of ZWL$582.7 million for its financial year ended 30 September 2022. This was a rebound from a ZWL$318 million loss in the previous year according to the company’s unaudited accounts.

- Operating profits for the year stood at ZWL$3.1 billion while gross profits stood at ZWL$4.1 billion.

- Total revenue stood at ZWL$12.2 billion, which was a 7.7% rise from the unaudited 2021 comparative. Export sales were up by 2.9% to ZWL$6.3 billion, while local sales increased by 21.7% to ZWL$5.89 billion.

- Packed tea sales contributed ZWL$5.9 billion, despite volumes dipping by 9% from the previous year. The decline was attributed to to falling disposable income in the local economy stemming from the tight liquidity conditions. Sales volumes to the regional markets increased by 57% despite logistical delays during the peak winter season. The company introduced new products during the fourth quarter – Makoni, Rosella and Resurrection herbal infusions.

- Bulk tea sales stood at ZWL$3.8 billion as export sales grew by 11% and the average selling price marginally increased to US$1.42 per kg from US$1.39 in the previous year.

- Macadamia sales were at ZWL$1 billion as export volumes declined by 16% and average prices fell from an average of US$5.12 per kg to US$3.26 per kg during the year. The company attributed the depressed volumes to changing preferences towards kernel from the traditional nut-in-shell market. In response, the company has identified alternative markets and potential value addition strategies.

- Revenues from avocado sales stood at ZWL$826 million, as volumes grew by 7% from the prior year. Prices for the fruit declined to US$0.44 per kg from US$0.71 per kg during the year, as the European market experienced an oversupply. The company expects demand and prices to firm, and has added 49 additional hectares of avocado plantation during the year, leaving the total area at 497 hectares.

- Coffee sales amounted to ZWL$229 million, as export volumes increased by 14% and prices firmed marginally to an average of US$6.56 per kg from US$6.50 per kg.

- The company’s operations utilized cash flows of ZWL$750 million and spent ZWL$976 million on capital investments.

- Total assets stood at ZWL$25 billion, with cash holdings of ZWL$138 million, inventories of ZWL$5.3 billion and receivables of ZWL$3.8 billion. Total liabilities were at ZWL$6.5 billion, with no interest bearing debt, payables of ZWL$2.6 billion and deferred tax liabilities of ZWL$2.6 billion.

- Looking ahead, the company expects avocado and macadamia yields to improve over the next three to five years as the plantations mature. It also expects its investment in new machinery at the Mutare packaging facility to drive volumes in the local and regional markets. The company will enhance its mechanized farming practices to optimize efficiency.

- In the boardroom, long serving director Mr.J. Moxon retired from service. The reconstituted Board comprises additional non-executive directors; Ms. Rufaro A. Maunze, Messrs S. Cranswick, L. Gwata, S. Hammond and M. Moxon who were appointed with effect from 30 July 2021.

- The company declared a final dividend of USc0.06 per share.

Commentary and Analysis

The change of reporting date and mismatched financial figures narrows the scope of the analysis somewhat. However, the company’s export oriented operations should offer a shield against the constrained local consumer environment, as well as the volatile monetary conditions. The foreign currency earnings should also allow the company to access USD denominated debt to invest in capital projects. Its liquidity and working capital positions appear healthy. The major concern lies in external developments, as key markets in Europe and China face depressed economic outlooks.

Increased value addition looks to be a key long term strategic pillar for Tanganda – which should mitigate its exposure to price volatility in primary agricultural markets. In the process, the company will need to balance its internally generated resources between sustaining its established export business and expanding its value-added product portfolio. Having previously teased the possibility, it is foreseeable that the company will eventually migrate to the VFEX to raise additional capital. The strong growth in regional packed tea sales conveniently suggests there is scope for Tanganda to establish its value-added products in the markets. The company’s low historic revenue growth outlines the need for a resilient growth driver.

On the ZSE, since its February 2022 relisting the Tanganda share has gained 42% in nominal terms and lost 77% in implied US dollar terms. The share peaked at ZWLc34,101.96 in April before falling to current levels as investors cashed in. It is currently trading at a price to book ratio of 1.2x – Harare