…as Diversification Strategy Takes Shape

By ETimes

Financial Performance Highlights

- ZSE listed property group Mashonaland Holdings saw its after tax profits rise by 2968% in inflation adjusted terms to ZWL$236.4 billion.

- The surge in profit was primarily driven by investment property fair value gains of ZWL$242.7 billion. Operating profits (before fair value adjustments) increased by 781% to ZWL$34.6 billion, with foreign exchange gains contributing ZWL$32.4 billion.

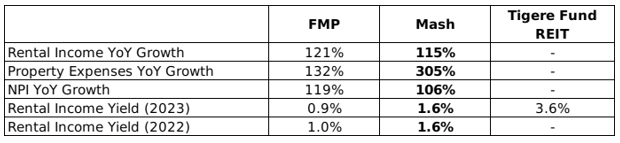

- Revenue growth was comparatively subdued, rising by 150% to ZWL$8.7 billion with rentals increasing by 115% to ZWL$7.2 billion.

- The group generated ZWL$7 billion in net operating cash flows, which saw net investment expenditures of ZWL$2 billion and a net increase of ZWL$1.3 billion in cash.

- Total assets stood at ZWL$481.5 billion, with investment properties making up ZWL$453.4 billion and cash holdings of ZWL$14 billion.

- Total liabilities increased by 78% to ZWL$38.9 billion, with total borrowings at ZWL$13.8 billion.

- On the group’s segments, Office space remained the main as its NPI increased by 78% to ZWL$3.1 billion. According to the group the CBD office sub-sector suffered from low absorption rates due to low economic activity. The group also noted the increased preference by corporates for suburban or out of CBD office spaces.

- The groups highlighted the resilient performance of the industrial property segment, noting steady demand for strategically located warehouses as NPI climbed 371% to ZWL$1.7 billion.

- Pure retail saw a 95% rise in NPI to ZWL$481 million, and the residential, health and land segment saw NPI decline by 16% to ZWL$297 million. According to the group, the development market has been depressed by high construction and capital costs. However, the group also noted that residential properties continue to represent an attractive investment for developers due to positive demand.

- Updating on ongoing projects the group said the Pomona Commercial Center Development had completed its preconstruction phase and is scheduled for completion by Q4 2024. The Milton Park Day Hospital Project is now 90% complete and procedures are underway for the tenant to commence their lease in November 2023. The Mashview Gardens Project is substantially complete and the units are scheduled for September 2023.

- Looking ahead, the group will strategically focus on portfolio diversification and portfolio optimization.

- The group declared a dividend of USc0.00761 and ZWLc0.1535

Commentary and Analysis

On paper, it’s a performance that was largely driven by fair value and exchange gains. On comparison, the group’s inflation adjusted growth in rental income and NPI closely aligned with listed peer First Mutual Properties, and rental income yield for both was flat during the period. So, signs point to an otherwise unremarkable set of results. The key takeaway is that the group’s revenue is more or less dollarized, or trending towards it. This should improve the group’s internal capacity to finance its projects and exploit emerging opportunities in the property market. There has been a longstanding need for Mash to diversify away from the historically depressed CBD office and industrial property sub-sectors. The difference in rental income yield with the Tigere Fund suggests that the money is or was in residential retail. The country’s persistent macroeconomic volatility has been increasing the appeal of high quality commercial property investments. Arguably, there is a long-term risk that presently attractive property markets could become over-saturated as investors maintain a preference for low-risk/safe-haven assets. Mash Holdings has to carefully navigate its portfolio diversification to avoid saddling itself in the future with another under-performing property class.

On the ZSE, since the start of 2023 the Mash Holdings share has gained 1,252% in nominal terms and 64% in implied USD terms. The share is currently trading at a price to book ratio of 0.48x.