By ETimes

Financial Performance Highlights

- Listed manufacturing group Amalgamated Regional Trading announced a ZWL$1.5 billion inflation adjusted after tax profit for its financial year ended 30 September 2022. Upward fair value adjustments to investment properties of ZWL$1.6 billion and biological assets of ZWL$3.3 billion contributed significantly to the upturn in the group’s financial performance.

- The group’s total revenues climbed 3% to ZWL$19.6 billion, with overall volumes rising by 10% and export volumes increasing by 12%. Battery sales remained the group’s main revenue earner with sales of ZWL$18.1 billion, rising by 5% during the period after volumes increased by 10%. According to the group, the segment’s performance was negatively affected by supply chain disruptions in the first half of the year. The group added that constrained liquidity dampened demand in the local markets, while forex shortages in Malawi also reduced demand. Projects to expand the product range of the segment were halted following the interest rate hike.

- The paper segment saw its revenues decline by 4% to ZWL$4.3 billion as volumes fell by 15% while paper exports gained 5%. The group reported positive progress on the recapitalization and restructuring of the division However, it also noted that power supply challenges and restricted availability of waste paper presented significant challenges for the segment.

- The stationery segment had the highest revenue growth at 79% to ZWL$2.96 billion. With the segment resuming stationery sales, overall volumes increased by 39% and export volumes gained 177%. Increased foreign currency sales to the informal sector enhanced the segment’s capacity to access raw materials and spares. However, the group still noted that opportunities in the market could not be fully exploited due to the backlog on the foreign currency auction.

- The group’s plantation business reported a 9% rise in revenues to ZWL$777 million despite volumes falling by 2%.

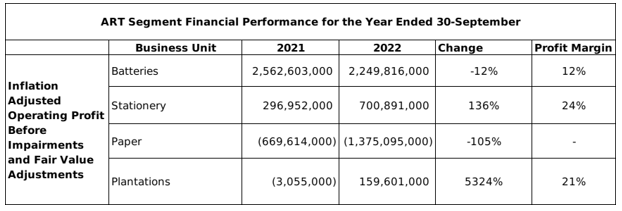

- In terms of profit, the batteries segment earned the largest at ZWL$2.2 billion, followed by the stationery segment at ZWL$701 million and the plantations segment at ZWL$159.6 million. The paper segment remained in the red, with its losses widening by 105% to ZWL$1.4 billion.

- During the year the group’s operations generated net cash flows of ZWL$2.1 billion, and net investment expenditures of ZWL$2.8 billion.

- The group’s total assets stood at ZWL$33.2 billion, with cash holdings of ZWL$197 million, inventories of ZWL$3.4 billion and receivables of ZWL$2.4 billion. The total liabilities reached ZWL$14.8 billion, with total borrowings of ZWL$1.998 billion, and payables of ZWL$4.2 billion.

- In the boardroom, Dr. O. Mtsasa retired and long serving member Mr. Y.C. Baik passed on. The group announced the appointment of Mr. S. Mupfurutsa as an Independent Non-Executive Director with effect from 1 August 2022.

- Looking ahead, the ART expects the operating environment to remain challenging, and expressed hope that the government will enact policies that are more supportive of the local manufacturing sector. According to the group, engagements with the government have been fruitful and resulted in mitigatory measures that should ensure the completion of expansionary capital investment projects. The group also reported that it had eliminated its expensive local currency debt since the year end, and will focus on cash generation, sustaining working capital improvement and optimally managing gearing levels.

- The group did not declare a dividend for the financial year.

Commentary and Analysis

On analysis, Amalgamated Regional Trading has generally struggled for consistency in recent years. The groups profit margins have declined noticeably in the last two financial years after a sharp increase in the preceding two years. Increased scrutiny on product pricing in formal distribution channels has likely played a key role in the decline. It could also reflect increased price competition from cheap imports as access to forex in informal markets has improved. The revenue share of the group’s batteries segment has also become more pronounced in the last five years, with volumes increasing by 167%. Operating profit margins in the segment have been fairly volatile during the period, currently at 12% for the just ended financial year, it has ranged between 1% (2021) and 60% (2019). Notwithstanding the volatile operating environment, the inconsistency suggests there may be some structural inefficiencies within the segment.

Going forward, the ongoing power supply challenges will likely have an adverse effect on the group’s production capacity and efficiency in the first half of the 2023 financial year. The group did not appear to invest significantly in working capital, which could be a concern as the local macroeconomic outlook remains uncertain. With the group’s low liquidity, a significant negative change in the macroeconomic environment could force it assume more expensive debt. The large size of ART’s intra-group sales suggests the batteries segment is to an extent supporting the groups other segments. That could magnify the adverse impact of production disruptions on the group’s financial performance – particularly as the tight liquidity conditions and pricing distortions are likely to depress growth in stationery and paper volumes sold through formal retail channels. Exchange losses of ZWL$3.6 billion versus net monetary losses of ZWL$847 million suggest the group needs to increase foreign currency takings to mitigate its exchange risk exposure.

On the ZSE, over the course of 2022, the ART Holdings share has gained 51% in nominal terms and shed 75% in implied US dollar terms. The share is currently trading at a price to book ratio of 0.6x – Harare