By ETimes

The Zimbabwe Stock Exchange closed negative amidst thin buying interest as concerns over fundamentals, such as measures to deal with a slowing economy, are still haunting the market.

Foreigners continued to exit the market after they sold $3.09 million and purchased $634,340.

Bears dominated proceedings, driving down the broad market.

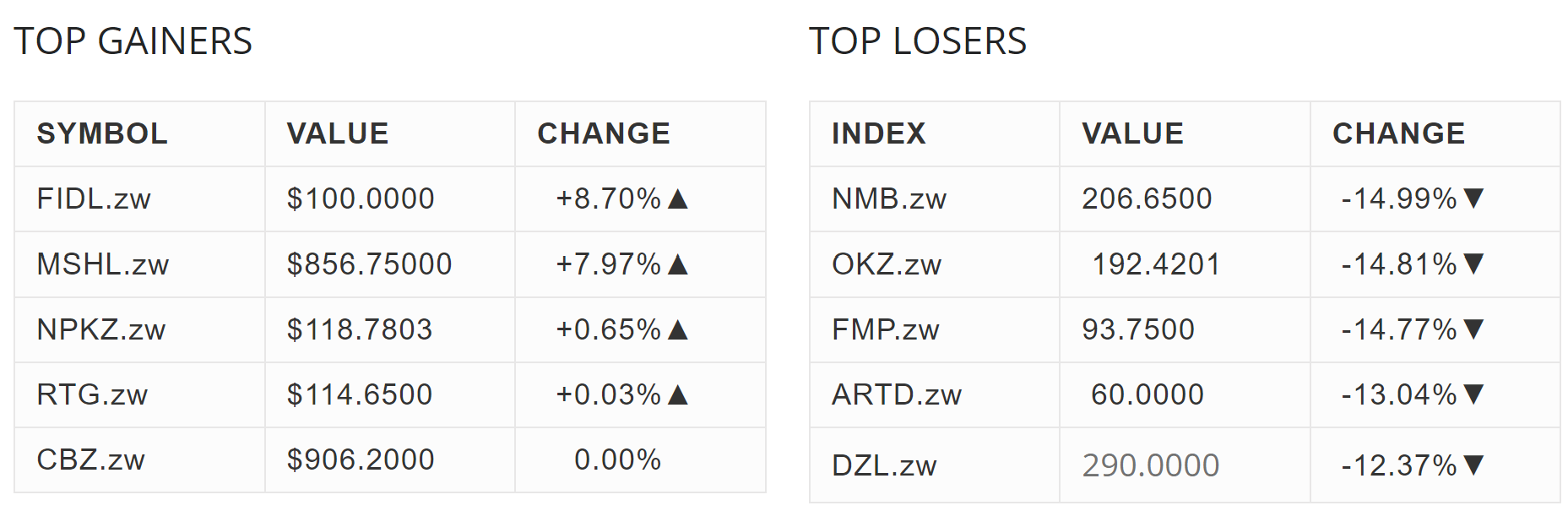

Market breadth closed negative as NMB led 15 laggards and 5 gainers, topped by Fidelity at the end of today’s session.

The ZSE All Share depreciated by 1.98% to close at 132,380.43 points, while market capitalisation declined 0.86% to $10,53 trillion.

In the same vein, the Top 10 lost 2.41% to close at 63,103.02 points.

The Medium Cap Index was down 0.18% to end at 461,086.05 while the Small Cap Index was flat at 2,160,142.99 points.

Turnover for the day rose 72.83% to $1.94 billion. Delta had the most value traded garnering $1.55 billion.

Morgan & Co Multi Sector ETF lost $31.1167 to end at $208.9319. Cass Saddle Agriculture ETF was $0.6681 weaker at $6.0333 and Old Mutual ZSE Top 10 lost $0.4674 to $34.0000.

Datvest Modified Consumer Staples ETF eased $0.2581 to $9.7419. Morgan & Co Made In Zimbabwe ETF was the only ETF trading in the positive as it added $0.6500 to $7.6500.

TIGERE REIT traded unchanged at $254.2812.

There was bloodshed on the VFEX, with First Capital Bank topping the losers set, down 8.16% to close at US$0.0180. Hotelier African Sun depreciated 4.24% to settle at US$0.0406. Innscor Africa Limited shed 0.02% to end at US$0.4499 – Harare

Advertisement