By ETimes

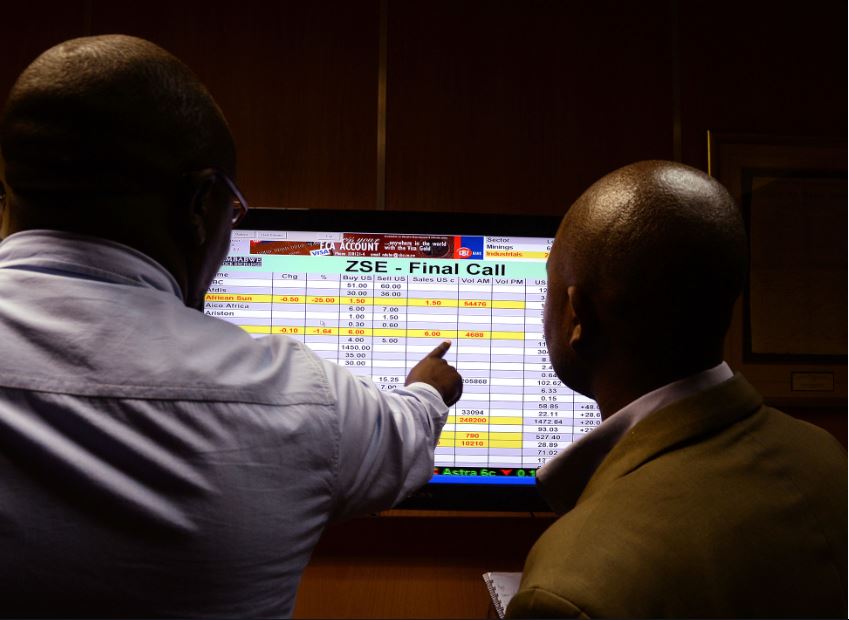

Stocks fell Friday amid lingering concerns over the tight liquidity of the Zimbabwe dollar.

It comes as the apex has lately instituted a tight monetary targeting framework to curb inflation, which analysts say has been driven by money supply growth.

The mainstream Zimbabwe Stock Exchange All Share Index depreciated by a negligible 0.24% to close at 116,748.92 points.

Conversely, market capitalisation firmed 1.15% to $9.27 trillion.

The Top 10 Index suffered the most, falling 0.49% to close at 52,904.70 points.

The Medium Cap Index added 0.19% to 443,922.54 points, while the Small Cap Index was 0.60% higher at 2,173,204.30 points.

A total of 3.81 million shares valued at $2.2 trillion were exchanged in 311 deals. Transactions in the shares of Delta topped the activity chart with 992,400 shares valued at $1.68 billion.

Delta’s revenue for the first quarter ended 30 June 2023 surged by 163% in inflation adjusted terms compared to a growth of 929% in historical cost terms. This was attributed to growth in volume.

“The revenue in US Dollar terms grew by 10% over prior year,” the group said in a trading update.

“The Zimbabwean entities continue to generate sufficient foreign currency through domestic sales with average collections of over 80%, which reflects the constrained ZW$ liquidity and trading challenges affecting formal sector outlets.”

Delta issued a cautious outlook.

“The operating environment in Zimbabwe will be impacted by the election season and the complex macro-econonmic factors,” it said.

Morgan & Co Made in Zimbabwe rose 10.01% to $6.4500.

In the red was Datvest Modified Consumer Staples ETF which eased 0.27% to $8.2800.

Other ETFs remained flat.

There was blood shed on the VFEX. Axia was the only gainer, up 0.19% to US$0.0523.

On the flip side, Bindura shed 6% to US$0.0141. Padenga fell 3.47% to US$0.1640.

Innscor Africa Limited was 3.25% lower at US$0.4036.

Simbisa depreciated by 2% to US$0.3326.

SeedCo International lost 0.74% to US$0.2516 – Harare