By ETimes

Caledonia Mining Corporation Plc share price remained flat on the week’s opening amid the mining giant’s announcement that production was below expectations in May and the first half of June.

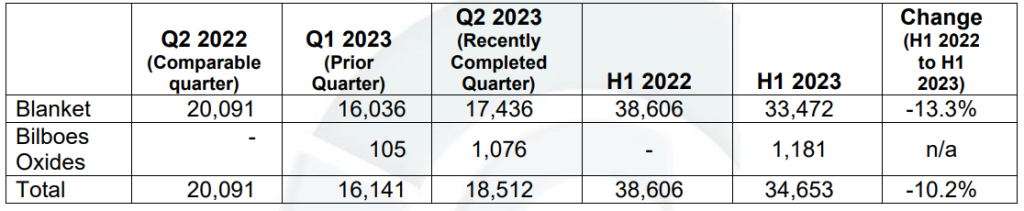

Production at its Blanket Mine in the quarter ended June 30, 2023, rose 8.7% to 17 436 ounces from 16,036 ounces produced in the first quarter of 2023.

Unfortunately, in the first six months of 2023, gold output at its Gwanda based mine fell 13.3% to 33 472 ounces from 38 606 ounces in the same period last year.

The newly acquired Bilboes Oxides produced 1,076 ounces in the quarter, showing an increase from the 105 ounces produced in the first quarter of 2023.

Caledonia’s share price was flat at US$16.0000.

Commenting on the announcement, Mark Learmonth, Chief Executive Officer, said: “Management interventions to identify and address the problems appear to have been successful and production improved substantially in late June and early July. Production in the first week of July was at a record level and was almost 400 ounces better than planned.

“Whilst we have much work to do to make up for the production shortfall from the first six months, we are confident that we will do so and we therefore re-iterate our production guidance for 2023 of between 75,000 and 80,000 ounces of gold,”

Source: Caledonia

The outlook for the Bilboes Oxides is insufficiently certain unless it is done in conjunction with the waste stripping for the sulphide project, according to Learmonth.

“Accordingly, we have decided to return this project to care and maintenance until the work commences on the larger sulphide project when the remaining oxide material will be mined and processed alongside the sulphide ore.

“This outcome has no bearing on the quality of the much larger sulphide project which was the sole reason for acquiring Bilboes,” he said.

Elsewhere on the VFEX price sheet, First Capital Bank Limited led the losers table, down 9% to close at US$0.0182.

African Sun, followed, depreciating by 8.86% to close at US$0.0370.

Padenga plunged 2.43% to US$0.2000.

Simbisa was off 2.35% to end at US$0.3690.

SeedCo International eased 1.70% to close at US$0.2600.

Axia and Innscor Africa Limited shed 0.59% and 0.28% to close at US$0.0500 and US$0.4487 respectively.

The Zimbabwe Stock Exchange (ZSE) continued pointing southward, losing 2.12% to close at 129,028.70 points, while market capitalisation declined 1.57% to close at $10.21 trillion.

Losses in Econet and BAT saw the Top 10 Index falling by 2.36% to close at 61,667.97 points.

The Medium cap Index was down 1.73% to close at 446,560.72 points while the Small Cap Index depreciated by 0.72% to close at 2,144,594.50 points.

Market turnover increased by 68.88% to $2.38 billion-HARARE