…posts 75% jump in order book

By ETimes

Masimba Holdings’ order book was worth about US$145 million in the first six months of 2022, up from $83 million in the comparable period last year, aided by demand for its construction and services business.

Masimba, which is one of five companies contracted by the government to undertake roadworks on the Beitbridge to Harare highway, said the operational environment remained unpredictable.

It was marked by persistent and widening differences in foreign exchange prices between the official and alternative markets that made it difficult to analyze financial statements.

“While the economic outlook is forecast to remain constrained, the current state of infrastructure development presents opportunities for the business in the future,” said group chairman Greg Sebborn in a statement accompanying the results.

The group has a stable, varied order book with tenures ranging from three to eighteen months.

“The book is well balanced and diversified between public and private sectors. However, execution thereof may be hampered by pricing distortions emanating from an inefficient foreign currency allocation system and prevailing hyperinflation.”

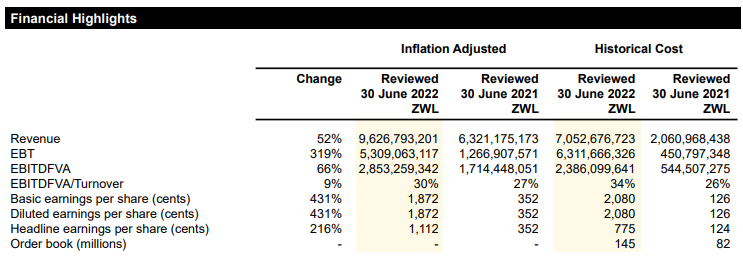

In terms of financials, six-month inflation-adjusted revenue increased 52% to ZWL9.6 billion, aided by a strong order book in the mining, infrastructure, and roads segments.The percentage of revenue received in US dollars increased to 55% (2021: 35%) of total revenue as a result of a diverse project portfolio.

Profit before tax grew by 319% to ZWL5.3 billion.

“The positive performance was underpinned by production efficiencies and exchange gains emanating from a net foreign currency asset position and fair value adjustment on investment properties,” he said.

The total asset position as at the reporting date closed at ZWL28 billion, up from ZWL25 billion in the prior period. This was attributed to the revaluation of plant and equipment and investment property, resulting in a revaluation surplus of ZWL6.2 billion and a fair value gain of ZWL2.4 billion under inflation adjusting reporting.

Cash generated by operating activities declined by 74.96% to ZWL194 million from ZWL775 million in the previous period.

“The decline in cash generated by operating activities was due to the impact of delayed payments resulting from contractory fiscal policy.”

He said the decrease in operating cash flow was primarily caused by the increasing need for working capital to fulfill the expanding order book.

It did not declare a dividend.

“The Board, having evaluated the cash flow associated with the growing order book, deteriorating cash flow cycle coupled with the need to strengthen capacity, has resolved not to declare an interim dividend,” he said.

Long term, the group maintains a cautious optimism and will implement strategies to protect its ability to create value – Harare