By ETimes

ADVISORY firm IH Securities says the Reserve Bank of Zimbabwe’s repricing of interest rates on current loans will push banks to generate significantly more interest income in FY22.

In the face of the Covid-19 epidemic, the banking sector has proven resilient, enduring the crisis and helping to reduce its wider economic effects.

“Demand for new loans in ZWL should however register lower due to the current prohibitive tariffs whilst consumer interest US dollar loans will likely remain elevated given relative affordability,” IH Securities said in its latest banking report.

There has been a progressive increase in the appetite for lending banks, according to the report.

The report noted that the industry has been able to conduct business in US dollars largely to increase FCA balances in the banking system and assistance in the form of external credit lines. Resultantly, 65.9% of loans as of June 2022 were in foreign currencies.

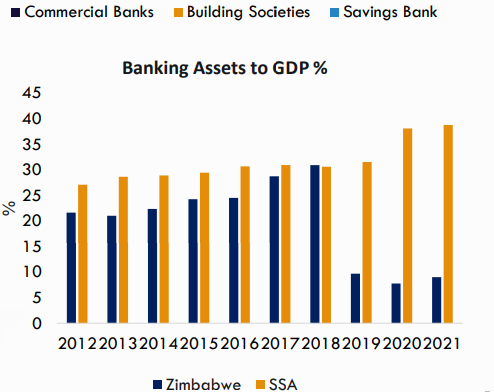

Profitability metrics for Zimbabwe were generally in line with regional averages in 2017 and 2018 during the dollarization era, according to IH Securities.

“Return on assets (RoA) and return on equity (RoE) have since dislocated with onset of hyperinflation and have generally remained elevated compared to regional peers owing to ballooning fair value income lines,” it said.

“However, disruptions to the sector owing to Covid-19 saw RoE slowing down to 42% in CY21 versus 59% the previous comparable year.”

The reported non-performing loans for the sector have consistently fallen below the advised criteria.

“Reported NPls for the sector have remained below the recommended thresholds by a significant margin, we however foresee higher downside with existing clients potentially unable to service debt at elevated interest rate levels,” it said –Harare