By ETimes

Zimbabwe’s main problem still revolves around increasing the money supply, warned IH Securities (IH).

This comes as experts have continuously warned that the growing uncertainty within the economy can only be addressed by dealing with the symptoms.

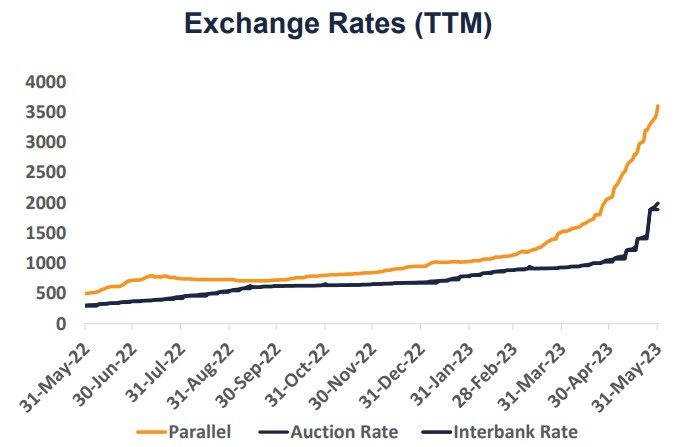

Authorities continue to ramp up efforts to promote the use of the local unit despite its continued depreciation against the greenback.

The majority of businesses and consumers prefer to hold onto the US dollar to hedge against inflation.

However, the government keeps tightening its monetary policy stance to stabilise the economy.

“With Treasury now handling external loans, money supply is expected to remain under a leash as the 25% USD retentions will be settled using tax revenue. The reduction of USD IMTT will hopefully encourage some return of USD deposits into the banking sector, potentially resulting in some uptick in liquidity,” IH stated in its May monthly snapshot.

“To prevent a complete slide into dollarisation, it was critical that the government show conviction in the ZWL by creating demand for it. By allowing all customs duties to be payable in ZWL, we expect demand for the local currency to increase. Theoretically, this should trigger private sector participation on the supply side of hard currency as companies sell to meet obligations.”

The research firm expects more power challenges to hit the country amid foreign currency turmoil.

“On the other hand, we might experience increased power supply disruptions as foreign currency inflows to ZESA are reduced,” IH said, adding that “Whilst it is commendable that authorities are enacting measures to neutralise excess liquidity on the market, the key issue remains expanding money supply.”

Director of the Public Policy and Research Institute of Zimbabwe, Gorden Moyo, said the whole thing is just about wrapping the bleeding cancer wound with a bandage and then celebrating that the patient is on the road to recovery.

“The government has for too long been attending to symptoms without paying attention to the fundamentals. None of the measures announced by the Treasury are addressing the systemic and structural issues that are undercutting whatever effort they believe they are making,” he said.

He said there is a need to stop illicit financial flows, curb corruption and honestly re-engage the international community – Harare

Advertisement