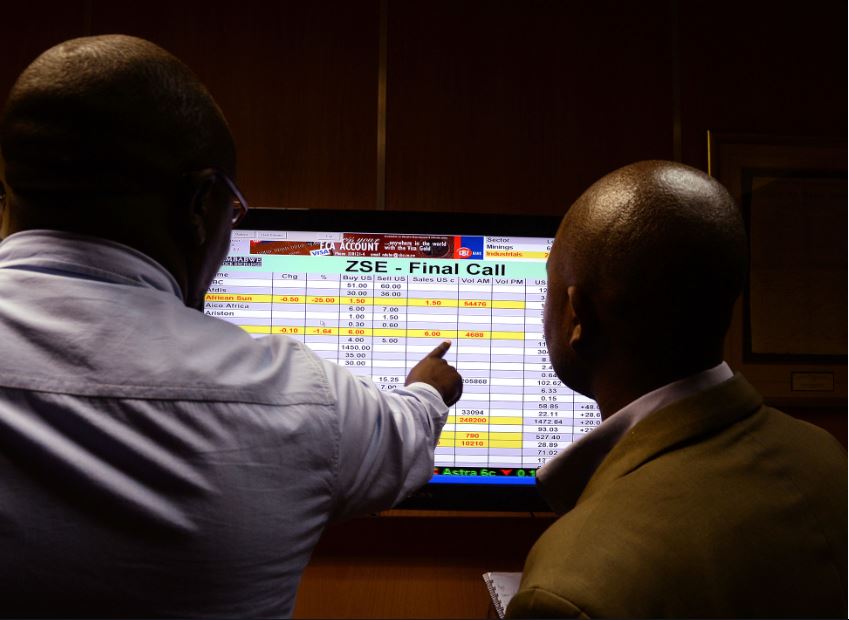

…as ZSE gain $7.98bn in midweek trade

The Zimbabwe Stock Exchange (ZSE) extended its upward trend on Wednesday, as mid-tier stocks rallied to leave the market in the black.

With more companies releasing their third quarter earnings, investors are reacting positively to the results.

Today marks the listing of the first Real Estate Investment Trust (REIT), the Tigere Property Fund.

Finance Minister Mthuli Ncube, who spoke to ETimes on the sidelines of the official listing of Tigere REIT, said that the local bourse remains attractive for companies amid their migration to the Victoria Falls Stock Exchange (VFEX).

“We expect more listings going forward,” he said.

“So, I am very pleased that both the ZSE and VFEX are attracting listings, and we will do everything we can to make sure that we provide further incentives for companies to come on board and raise capital through the capital markets.”

At the close of midweek trade, the mainstream ZSE All Share Index rose 0.47% to close at 14,577.46 points. The session yielded 13 gainers and 9 laggards.

Gains in Delta saw the Top 10 Index rise by 0.12% to close at 8,495.75 points. Delta added 1.30% to end at $235.26.

Partially offsetting the gains were BAT which lost 1.62% to end at $3,049.66 and EcoCash was down 1.05% to settle at $34.95.

Mash Holdings, which is rumored to have found buyers for some of its properties on the market, was the highest gainer today. The stock gained 12.36% to close at $20.00. It was followed by NMB, which increased by 12.04% to close at $29.97. Horticulture exporter Ariston rose 23% to end at $3.99. First Capital Bank appreciated by 7.56% to close at $10.28.

On the flip side, OK Zimbabwe, which topped the losers’ chart today, depreciated by 6.01% to close at $28.10 per share. Milk processor Dairibord lost 4.08% to settle at $39.96. Cold tea, as Tanganda eased 2.66% to $81.11.

The Small Cap Index was flat at 472,431.36 points.

Market capitalisation increased by $7.98 billion to $1.61 trillion.

Turnover for the day increased to $189.97 million from $71.75 million previously.

Morgan & Co Made in Zimbabwe added $0.1624 to $1.3740 and CASS Saddle Agriculture remained flat at $2.0000. Old Mutual ZSE Top 10 shed $0.6512 to close the session at $5.3861, Datvest modified consumer staples lost $0.1673 to $1.5327 and Morgan & Co Multi Sector fell by $0.1667 to $20.8333 – Harare