By ETimes

The Zimbabwe Stock Exchange rallied for the fourth consecutive day on Thursday, with the mainstream All Share rising 0.78 percent to 13,591.97 points at the close of the trading session.

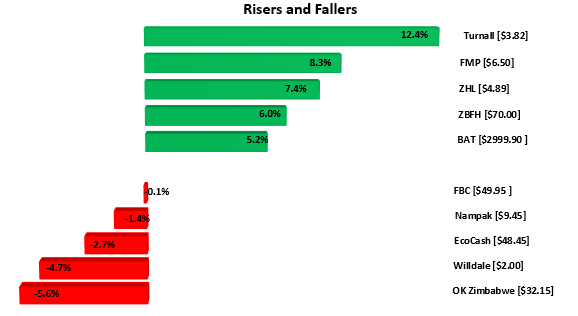

The session yielded 20 gainers and 8 fallers.

Cigarette manufacturer BAT was the top blue-chip performer, gaining 5.26% to finish at $2999.90 and leaving its market capitalisation at $61.89 billion. Accordingly, the Top 10 Index recovered 1.11% to close at 8,009.37 points.

On the other hand, EcoCash shed 2.79% to settle at $48.45.

Property firm FMP climbed up 8.33% to end trade at $6.50. ZHL was 7.44% higher to $4.89. ZB, the banking counter, gained 6.07% to $70.00.

The Medium Cap Index rose 0.06% to close at 29,938.97 points.

Retail giant OK Zimbabwe was the worst performer, losing 5.64% to close at $32.15. Nampak lost 1.47% to $9.45. Banking counter FBC fell 0.10% to $49.95 and completed the top five losers’ set.

Turnall led the overall risers, gaining 12.43% to close at $3.82. The Small Cap Index gained the most after it closed 1.58% up to 501,065.24 points.

On the flip side, brick maker Willdale eased 4.76% to end at $2.00.

Turnover declined to $410.59 million from $600 million in the previous session. The market cap increased by $12.17 billion to $1.65 trillion.

The Datvest ETF garnered 0.04% to close at $1.7100, while the OML ETF gained 0.14% to end at $5.2000. The Cass Saddle Agriculture ETF and the Morgan & Co Made in Zimbabwe were both flat at $2.0000 and $1.2000 respectively.

Losses were recorded in Morgan & Co Multi Sector ETF, which paired 4.67% to $24.0000.

Meanwhile, the Reserve Bank of Zimbabwe has appointed Dr Innocent Matshe as Deputy Governor effective from 1 October 2022 replacing Dr Kupukile Mlambo whose tenure expired in June this year.

Oil prices firmed on Thursday, finding continued support from an Opec+ decision last week to cut supplies, as the International Energy Agency (IEA) warned that those cuts may push the global economy into recession.

Brent crude futures rose 49c, or 0.5%, to US$92.94 a barrel. US West Texas Intermediate crude was up 37c, or 0.4%, at US$87.64 a barrel.

Last week, oil cartel Opec+ pushed prices higher when it agreed to cut supply by 2-million barrels per day

Gold prices flitted in a tight range on Thursday as market participants maintained a cautious stance ahead of a key US inflation reading that could influence the size of the Federal Reserve’s next interest-rate hike.

Spot gold held its ground at US$1,670.20 per ounce. US gold futures dipped 0.1% to US$1,676.50.

Though traditionally considered an inflation hedge, rising interest rates to combat high prices have reduced bullion’s appeal since the metal yields no interest-HARARE