…as investors gain $120,12bn

By ETimes

The Zimbabwe Stock Exchange ended the week’s trading session on a positive note, as the mainstream ZSE All-Share Index (ASI) rose by 4.77% to close at 24,782.89 points.

This was against Thursday’s trading session, which closed at 23,653.77 points.

Accordingly, the market capitalisation increased by $120.12 billion to close at $2.67 trillion.

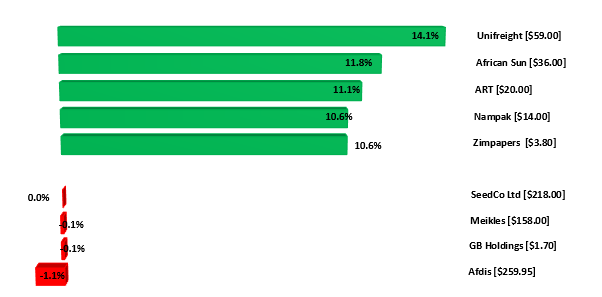

Market breadth strengthened as 22 stocks advanced against the 4 decliners.

The Top 10 Index gained the most, going up 5.65% to end at 15,222.34 points. Innscor, Delta and Axia climbed by 6.46%, 9.53% and 6.65% to close at $809.78, $476.72 and $114.84 respectively.

The Medium Cap Index was up 2.67% to finish at 50,707.50 points.

Consequently, the Small Cap Index recovered 1.52% to close at 504,953.31 points.

In 241 trades, turnover fell by 80.19% to $512,53 million.

Innscor led the day’s trading with 239,500 shares valued at $193.94 million. Hippo exchanged 238.900 shares valued at $106.55 million. Axia sold 588,800 shares worth $67,61 million.

Old Mutual ZSE Top 10 added another $0.1292 to $7.8478.

On the other hand, the Cass Saddle Agriculture ETF eased $0.1011 to $2.2500. Datvest Modified Consumer Staples ETF lost $0.0047 to $1.4696 and Morgan & Co Multi Sector ETF was down $0.4565 at $24.0000.

Morgan & Co Made In Zimbabwe ETF was unchanged at $1.3000.

Tigere REIT remained flat at $50.6200 after declaring its maiden interim dividend of US$152,577 (or 0,021 United States cents per unit) as well as an additional ZWL$75,816,772 (or 10,54 Zimbabwe cents per unit) with respect to the period ended 31 December 2022.

“Performance of the asset for the period was in line with expectations and both assets will reach 100% occupancy levels within Q1 of 2023,” it said in a statement.

Advisory firm IH Securities said the stock market appears to be returning to positive territory after slowing down by 75% in real terms in 2022 due to a plethora of buying possibilities.

“While fundamentals speak to a bullish stock market in 2023, in 2022 we observed a dislocation between fundamentals and the ZSE stock market performance,” IH said.

“The uncertainty around money supply developments in 2023 propels us to lean more towards defensive stocks that have strong dividend policies in case capital gains remain subdued.”

The local bourse, against all odds, finished five straight days on a bullish note-HARARE