By ETimes

The highly anticipated gold-backed digital token has hit the market despite some mixed feelings from the market on whether it will survive its purpose.

A gold-backed digital token is a type of cryptocurrency that is backed by physical gold. The value of the token is tied to the price of gold, which provides stability and security for investors. These tokens can be used for transactions and investments, similar to other cryptocurrencies.

With the most recent release of gold-backed digital tokens, the central bank has been proactive in managing liquidity in the economy. This comes as the gap between the official and parallel markets continues to widen, which has created pricing challenges in the economy.

On the black market, the local currency is trading at around $2,300x per US dollar, while the official rate is $1,212.54.

As of today, a gold-backed digital token per milligram was going for US$0.0685 or ZWL99.72.

In Zimbabwe, where the local currency has been plagued by hyperinflation and instability, a gold-backed digital token could provide an alternative form of currency that is more stable and reliable. The country has a significant amount of gold reserves, which could be used to back a digital token.

The gold-backed tokens will be entirely backed by actual gold that the apex bank owns.

The minimum vesting period has been established at 180 days and the digital tokens will be stored in e-gold wallets or e-gold cards that may be traded through person-to-person and person-to-business settlements.

Owners of actual gold coins will have the option to swap or convert their holdings into digital tokens backed by gold through the banking system.

The Bank further advises that payment for the gold-backed digital tokens or physical gold coins in ZWL shall continue to be made at the current 20% margin above the interbank mid-rate and that the price of the gold-backed digital tokens in foreign currencies shall remain the same as the price model of the physical gold coins.

“Whilst the attraction for gold coins was the arbitrage presented when buying in local currency, the same can be said for the digital gold-backed coins, which provide an incentive for players to willingly surrender their excess RTGS,” IH Securities said in its monthly snapshot.

“In our view, there is however likely going to be a confidence issue with the digital gold coin lowering uptake of the product and hampering intended effectiveness of neutralizing excess liquidity. In this regard, pressure on the ZWL in the short term is expected to sustain.”

For some, this concept of tokenisation of gold coins does not work. This is in view of the fact that the increased supply of gold backed currency will result in hyperinflation reaching levels beyond control.

Further, the concept of e-gold tokens has already failed because it has failed in the past. In 1970, countries across the globe dumbed down their gold-backed currencies due to uncontrollable hyperinflation credited to their failure to redeem gold from reserve banks.

In the case of Zimbabwe, 35 tonnes of gold amounting to US$2.5 billion have been sold; the available gold reserves won’t sustain the monetary economy for a long time.

“There’s no confidence in the e-gold tokens because it’s not known how much gold is in the reserve bank vault. This implies that there’s a tendency for government misrepresentation of facts,” said economist Newton Mambande.

“That is, the issues of corruption and invasion of individual and corporate accounts are going to scare off investors because this scheme seems not to be different with freezing of accounts in October 2008 and October 2018, when the accounts were mopped up in order to enrich governing elitists.”

If you look at time, he said, it’s clear that the strategy is to woo voters with full knowledge that their monetary strategy doesn’t work in fighting inflation.

“This is why they are telling you that it would yield results after 180 days, in which 180 days would lapse after 180 days. By then, the strategy would already achieve the desired results of winning votes for them,” Mambande added.

However, there are also challenges to implementing such a system in Zimbabwe. The country has limited access to technology and internet infrastructure, which could make it difficult for people to use digital tokens.

Additionally, there are concerns about regulation and security in the cryptocurrency market.

The gold-backed digital coins, or they are a digital currency backed by gold, have actually seen a number of countries exploring the route of introducing gold coins across the world, so it’s in line with global trends. It provides an alternative store of value and alternative medium of exchange.

Another economist, Prosper Chitambara, said digital gold coins are fairly stable; there is no risk that they will be affected by inflation or other macroeconomic vagaries or volatilities.

“So I think they have inserted an important measure, but of course we should not view them as panaceas to the macroeconomic ills bedevilling our economy. I think they are just a currency or even a store of value, and we should not think that they are going to solve the macroeconomic problems that we are facing.

“To solve the challenges, we have to address the drivers of instability, which are high money supply growth,” he said.

Even if the industry is shifting completely to the dollar, there are still some sectors of the economy, such as formal supermarkets, that are heavily dependent on the local currency, which puts pressure on their profits.

“Well, I think with time they will be accepted, but I think the challenge is that we are in a dollarising and most people prefer to transact in US dollars as the gold coins are a new phenomenon in the country and have taken a bit of time to accept that, but of course issues of liquidity are high liquid and tradable, and I think they could enhance their acceptability,” Chitambara added.

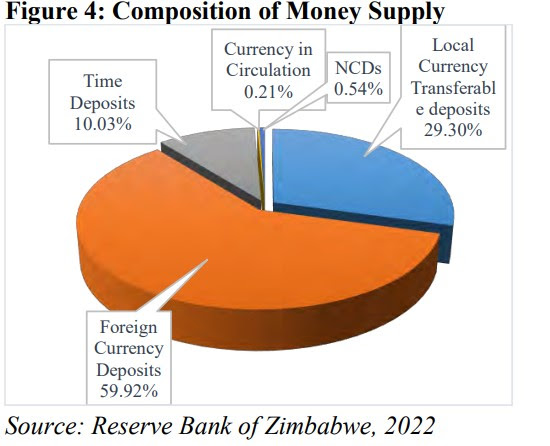

The country’s broad money supply, which consists of domestic and foreign currency deposits, increased to $2.9 trillion in February from $2.6 trillion in January 2023, the latest data from the Reserve Bank of Zimbabwe (RBZ) shows.

The money stock was composed of foreign currency deposits (59.92%), local currency deposits (39.87%), and currency in circulation (0.21%).

While a gold-backed digital token could potentially provide benefits for Zimbabwe’s economy, some say there are also significant challenges that would need to be addressed before such a system could be implemented effectively – Harare