By Stephen Chandisareva

HARARE – Shares of Nampak dropped 4.58% Tuesday after the packaging firm spooked investors with a going-concern warning in notes to its summarised financial statements for the year ended 30 September 2023.

In its 2023 annual report, the packaging said the going-concern doubt stems from an unstable business operating environment.

However, the company still has financial strength. It has positive working capital, meaning that it holds more current assets than current liabilities.

“As at 30 September 2023 the company’s current assets exceeded its current liabilities by ZW$1,01 billion (2022: assets exceeded liabilities by ZW$0,99 billion). In addition, the company had a profit for the year of $5.85 billion,” reads the annual report.

“The directors and management are aware of a number of material uncertainties related to events and conditions prevailing within the country’s economic environment that could cast significant doubt on the company’s ability to continue as a going concern.”

Nampak continues to keep a close eye on and assess the operational environment in order to reevaluate and suitably modify its strategy.

“This is to ensure the continued operation of the company into the foreseeable future. The directors are of the opinion that due to the plans in place, the company will be a going concern into the foreseeable future,” the company said.

The current share price of Nampak is $500.00. In USD terms, its market capitalisation stood at $32.37 million.

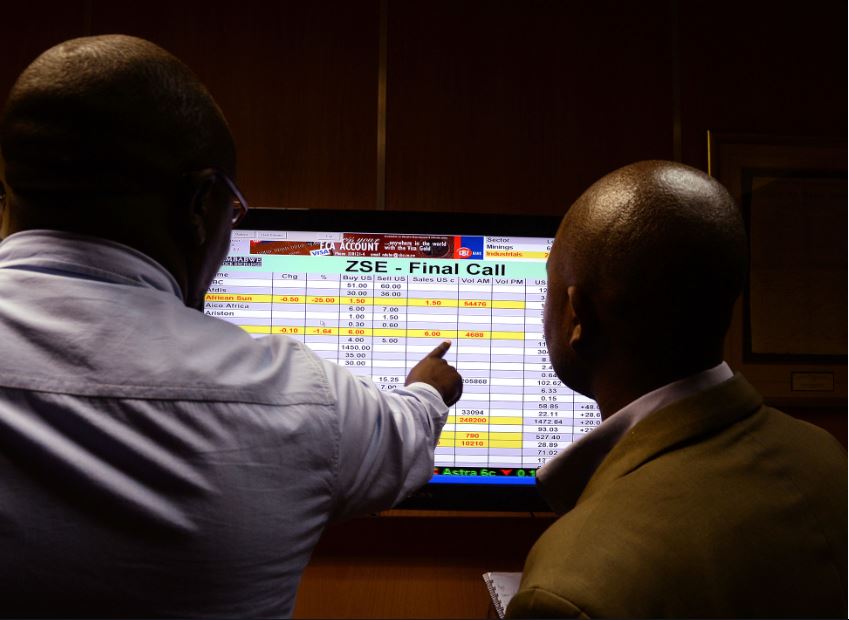

For the third consecutive session, the Zimbabwe Stock Exchange closed in negative territory on Tuesday, depreciating by 1.88% at the close of transactions.

The ZSE All Share Index declined during the session by 1.88% to close at 550,881.68 points, while the market capitalisation declined by $827.64 billion to settle at $43.62 trillion.

The session yielded 8 gainers and 16 losers.

Market turnover declined 44.07% to $1.03 billion.

Delta emerged as the most active stock on the market, transacting 75 500 shares worth $596.46 million, while SeedCo Limited followed with 61 000 units valued at $144.25 million.