By ETimes

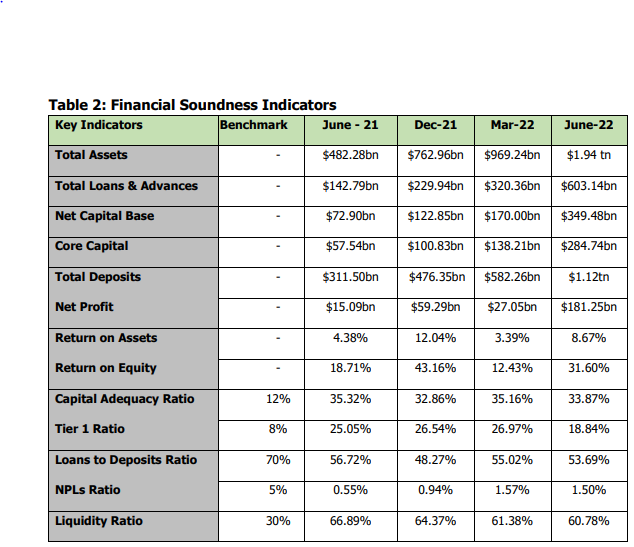

Eighteen out of 19 banking institutions reported profits in the first half of 2022, says the Reserve Bank of Zimbabwe (RBZ), with an aggregate profit of $181.25 billion for H1 2022, a notable increase from $15.09 billion reported in the prior period in 2021.

Although the Covid-19 problem has most directly impacted people and businesses, there are several mutually reinforcing channels connecting the financial stability of consumers and businesses, financial institutions, and governments that have an impact on the entire economy.

In the face of the Covid-19 epidemic, the banking sector has proven resilient, enduring the crisis and helping to reduce its wider economic effects.

RBZ’s first half banking sector report shows that non-interest revenue, which made up 79.03% of total income, was a major factor in the banking sector’s income growth. Revaluation profits on investment properties made up the majority of non-interest income (22.67%), followed by fees and charges (22.60%), and translation gains on assets denominated in foreign currencies (21.14%).

Despite the adjustments made for inflation and other things, Economist Victor Boroma said commercial banks are making a significant portion of their income from non-interest income. These include bank charges, POS charges and commissions, just to mention a few.

“This is very unhealthy for the economy because it means real lending is limited and creates a toxic dependency on the velocity of money or transitory deposits,” he said.

The sector’s large stock of liquid assets is reflected in the average liquidity ratio’s continued high level. The loans to deposits ratio gradually increased from 44.16% in March 2021 to 53.63% in June 2022, indicating that financial institutions are gradually increasing their lending, despite the ratio still being high (it reached a peak of 74.85% in June 2020).

As of June 30, 2022, the return on assets and return on equity ratios were, respectively, 8.67% and 31.60%, down from June 30, 2021, when they were, respectively, 13.55% and 45.54%.

Economist Yona Banda thinks a large part of those profits would have been from upward fair value adjustments of real assets held by the banks.

“The other factors are the high responsiveness of fees and commissions income to rising price levels,” he said.

“The increased lending rates must have contributed as well.”

In the six months ended June 30, 2022, the cost to income ratio decreased from the 75.95% reported as of June 30, 2021 to 60.78%. Of the $82.13 billion in operational expenditures for the banking sector, 45.07% and 41.68% were attributable to administration costs, salaries, and benefits for employees.

Total deposits in the banking sector surged dramatically, rising from $582.26 billion at the end of March 2022 to $1.12 trillion at the end of June 2022, or a gain of 92.40%.

According to the report, the average prudential liquidity ratio for the banking industry was 62.16% as of June 30, 2022. Seventeen of the 19 active banking institutions met the required minimum prudential liquidity ratio of 30%. To ensure compliance, the two institutions that did not meet the minimum standard are being closely watched on a regular basis.

The RBZ added that “it is envisaged that the safety and soundness of the banking system would be maintained” as the Bank and the government implement sensible monetary and fiscal policies that are putting the economy back on track to economic stability – Harare