By ETimes

Financial Performance Highlights

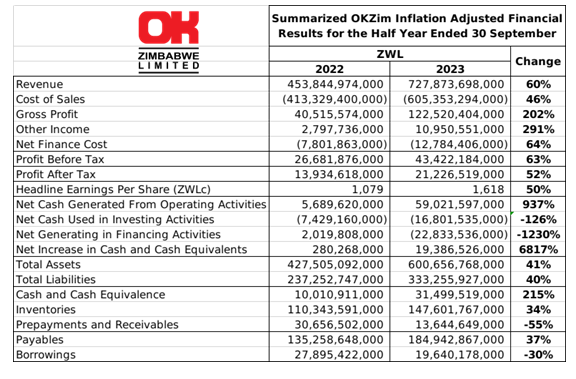

- ZSE listed retail group OK Zimbabwe reported a ZWL$21.2 billion after tax profit for its half-year ended 30 September 2023. The performance was a 52% inflation adjusted rise from the comparative 2022 period, while profit before tax was up 63% to ZWL$43.4 billion during the period.

- Commenting on the performance, the group noted that operating costs had increased by 886.83% mainly driven by utilities and backup power expenses, transport and delivery, maintenance expenses and labour costs. It also noted the adverse impact of the ZWL$32.4 billion incurred from exchange losses that arose from the group’s foreign currency denominated leases and liabilities. The group also utilized debt for its short to medium term growth plans, which resulted in a 63.86% increase in net finance costs.

- Gross profits increased sharply by 202% to ZWL$122.5 billion, after revenues climbed 60% to ZWL$727.9 billion.

- Revenue growth came despite the group reporting a 22.6% decline in volume. The group noted that its suppliers had resorted to shortened trading terms due to exchange rate volatility which resulted in instances of stock outs.

- The increased revenues saw the group’s net operating cashflows rise by 937% to ZWL$59 billion. Net investment expenditures reached by 126% to ZWL$16.8 billion, with the majority going towards the new Bon Marché Marondera store and a number of new Alowell Pharmacy outlets that are now fully operational at select outlets. Net cash flows for the year stood at ZWL$19.4 billion, up from ZWL$280 million in the 2022 comparative period.

- At the end of the period total assets stood at ZWL$600 billion, with cash holdings of ZWL$31.5 billion, receivables of ZWL$13.6 billion and inventories of ZWL$147.6 billion. Total liabilities reached ZWL$333.2 billion, with payables of ZWL$184.9 billion and borrowings of ZWL$19.6 billion.

- Looking ahead, the group outlined its strategic focus on implementing cost optimization initiatives across the operations, streamlining processes and renegotiating supplier contracts.

- The group did not declare a dividend.

Commentary and Analysis

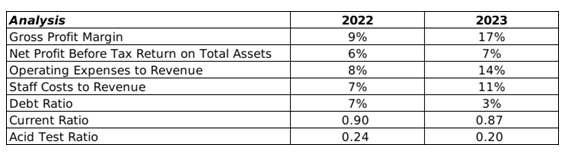

The key takes from the results are the sharp rise in operating costs and the decline in sales volumes. The group passed the cost escalations to the consumers, as suggested by the relatively stable Net Profit before Tax Return on Total Assets. The volume decline raises the question: Is it an outcome of depressed consumer capacity or is it indicative of the growing significance and competitiveness of informal retail? Formal retail operators have previously highlighted concerns about the rise of their informal peers. The sense has always been that its a potentially sensitive issue with a sharp sociopolitical edge. Prior comments from the Ministry Finance and Investments Promotion Perm. Sec. were suggestive of where government sympathies lay. So the move to limit procurement from manufacturers and wholesalers to licensed and tax compliant traders came as a bit of a surprise. Whilst the main objective of the government was probably to widen the tax net to the informal sector. But, the overriding sense is that the effect of the policy will be to create a class of middlemen within informal retail supply chains. This could reduce the competitiveness of locally manufactured products for the informal sector and drive a switch to smuggled imports. In which case, the issue for OKZim and other formal operators remains sustaining price competitiveness against exchange rate related pricing distortions and rising operating costs. So the battle rages on. Under the circumstances, the short term outlook for the group is subdued, with a competitive pressures and a weak consumer environment likely to weigh in HY2 – Harare