By ETimes

2023 Budget Overview and Analysis

As announced by Minister of Finance and Economic Development Mthuli Ncube, the government outlined its fiscal plans for 2023 in the November 24 budget speech. According to the Minister, the budget focused on maintaining a tight monetary and fiscal policy stance as an overriding objective. The budget also focused on support services for the informal sector, targeting better access to finance, training, and markets. In addition, the budget sought to accelerate economic transformation by prioritizing education, health and social protection programs to cater for the most vulnerable in society.

The budget speech also provided some update on key macroeconomic developments –

- The economy is now projected to grow by 4% in 2022, a further downward revision from the mid-year projection of 4.6%

- The economy is now projected to grow by 3.8% in 2023, compared to the NDS1 target of not less than 5%, on account of the uncertain global economic outlook and potential domestic adverse factors.

- The country’s total Public and Publicly Guaranteed (PPG) debt is estimated at ZWL$2.2 trillion for domestic debt and US$14 billion for external debt (including blocked funds of US$3.1 billion) as at end September 2022.

- Government is setting a month-on-month inflation target range of between 1% to 3%, and a fiscal budget deficit of not more than 1.5% of GDP during 2023. Deviations from these critical targets will warrant further interventions by both fiscal and monetary authorities

- As at 31 October 2022, US$3.6 billion has been cumulatively allotted through the exchange auction. The bulk of allotments were to the productive sectors of the economy, accounting for 73% of the total. Raw materials accounted for 41% of the total allotments, whilst 23% funded capital goods such as machinery and equipment, with 6% going towards medicals and chemicals.

- The current account balance improved to a surplus of US$340.5 million in the first half of 2022, compared to a deficit of US$97.2 million for the same period in 2021. To year end, the current account is projected to remain in surplus of US$448.9 million. The country’s external sector is expected to remain relatively strong in 2023, with a surplus current account of US$85.2 million.

- As at end of September 2022, reserve money stock stood at ZW$87.1 billion, compared to ZW$37.5 billion in August. Foreign currency statutory reserves amounted to ZW$44 billion as at end of September 2022, whilst the local currency component amounted to ZW$36.2 billion. The stock of reserve money was made up of foreign currency statutory reserves at (50.5%); ZWL$ statutory reserves at (41.6%); currency in circulation (7.9%); and banks’ liquidity at the Reserve Bank (0.11%

- Broad money recorded an annual growth rate of 425.8% to ZWL$1.9 trillion in September 2022 while domestic credit recorded an annual growth rate of 508.2% in September 2022,

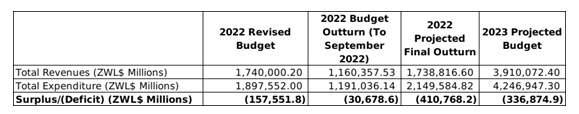

Budget Summary

- The government will be targeting revenues of ZWL$3.9 trillion during the year, a 125% increase from the 2022 projected final outturn.

- For expenditures, the government set the target at ZWL$4.2 trillion, up 98% from the projected final outturn of the current fiscal year.

- The targets leave the government with a projected fiscal deficit of ZWL$336.9 billion, which will trim the projected 2022 deficit by 18%.

- The government expects to finance the deficit with – VFEX bond issuances equivalent to ZWL$95.2 billion; external loan disbursements equivalent to ZWL$398.2 billion; Treasury Bill issuances equivalent to ZWL$82.2 billion; and Changes in bank balances equivalent to ZWL$10 billion.

Expenditures

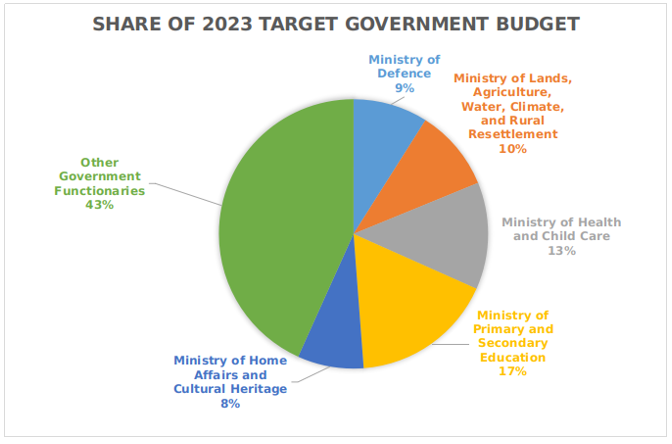

- Among the government ministerial portfolios, the Ministry of Primary and Secondary Education received the highest allocation at ZWL$631.3 billion. This was followed by the Ministry of Health and Child Care which received an allocation of ZWL$473.8 billion.

- The Ministry of Lands, Agriculture, Water, Climate and Rural Settlement was allocated ZWL$362.5 billion. The budget highlighted 13 ongoing programmes and projects that have been implemented by the government which include – the Presidential Cotton Scheme; the Presidential Rural Horticulture Development Programme; Presidential Poultry Scheme; and the Presidential Goat Scheme.

- The Ministry of Defence received ZWL$331.1 billion, while The Office of the President and Cabinet was allocated ZWL$161.7 billion and the Parliament received ZWL$47.8 billion.

- For the various government departments and organizations – the Public Service Commission drew an allotment of ZWL$37 billion; the Human Rights Commission received ZWL$3 billion; and the Zimbabwe Electoral Commission received ZWL$101.7 billion.

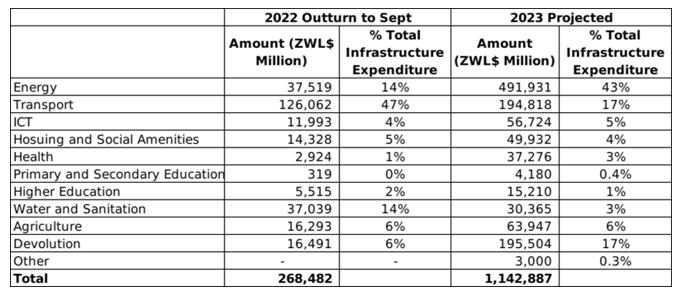

- The government expects to spend ZWL$1.14 trillion on infrastructure development during the 2023 fiscal year. The majority of the spending will be focused on Energy infrastructure, with ZWL$491.9 billion budgeted. Transport and devolution related infrastructure were both budgeted ZWL$195 billion.

- The expenditure is expected to be financed using fiscal resources (43%), statutory funds (12%), loans (44%) and grants (2%).

Key Policy Developments

- VAT rate has been increased from 14.5% to the previous rate of 15%, with effect from 1 January 2023

- With effect from 1 January 2023, the IMTT on foreign and local currency transactions to local currency transactions will be set at a rate of 2%.

- IMTT exemptions will be applicable to the transfer of funds to farmers, for the purchase of wheat by private off-takers approved by the Agricultural Marketing Authority, for the period 1 September 2022 to 31 March 2023

- The Road Access Fee per locally registered vehicle will be reviewed from ZWL$10 to US$10 or local currency equivalent per vehicle

- The flat rate of excise duty on energy drinks will increase from US$0.05 cents per litre to US$0.10 per litre, with effect from 1 January 2023.

- The penalty for late submission of tax returns will increase from ZW$30 per day to US$30 payable at local currency equivalent.

- The interest rate on local currency tax debts will increase from 25% to 200%, with effect from 1 December 2023

- The rebate of duty on capital equipment will be replaced with a suspension of duty on specified capital equipment imported by approved tourism operators, with effect from 1 January 2023. Additionally, the minimum value of capital equipment to be imported under suspension of duty will be pegged at US$25,000.

Commentary and Analysis

At the prevailing official exchange rate, the government is targeting an implied expenditure of US$6.56 billion for the 2023 fiscal year. This is a moderate increase from the projected 2022 fiscal year expenditure of US$5.5 billion, and marginally higher than the reported outturn for the 2021 fiscal year of US$6.3 billion. It is debatable whether previous government spending has benefited the average Zimbabwean. Perhaps correspondingly, the 2023 budget statement had a healthy sprinkling of the phrase “Value for money”. Leading into an election year with depressed economic growth prospects, high borrowing rates and no significant tax relief, the pressure is definitely on the government to deliver “value” to the public. However, if the “value” of US$6.3 billion in expenditures did not register in 2021, the year ahead could be testing. The pressure for impactful spending could increasingly stress the government’s tight liquidity regime and, in this context, another hyperinflationary cycle could have heavy consequences. On the other hand, the government expects improved procurement procedures and oversight to translate to more efficient use of fiscal resources. That could ease the pressure, although it is an implicit admission of significant waste in prior years. Either way, it promises to be an eventful year and with an equivalent of US$1.8 billion marked for infrastructure expenditure, observable results can be expected – Harare