By ETimes

SeedCo Limited, the country’s biggest seed producer, says it expects full year volume growth as well as a rise in the proportion of foreign currency sales despite a challenging operating environment.

As the economy became more dollarized, there was a surge in purchases made in foreign currencies.

“In Zimbabwe the business is expected to experience volume growth as well as a notable increase in the contribution of hard currency revenue from encouraging export growth and a significant increase in domestic sales in USD,” the company said in a trading update for the third quarter ended 31 December 2022.

“On a regional level, a mixed volume performance is predicted, with growth forecast in some regions of Southern Africa and East Africa and a drop due to drought in other regions of East Africa.”

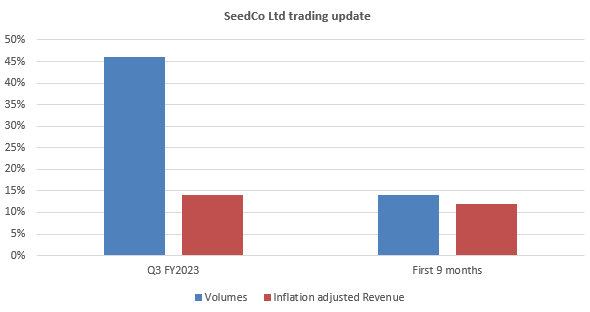

Volume, a key indicator of demand, rose 14% in the first nine months and went up 46% in Q3 FY2023.

“Volume increased by 14% over the past nine months compared to the same period prior year, and by 46% compared to the same quarter prior year, helped by ample stocks, exports, record local sales of wheat and soybeans as well as favourable rainfall projections towards the start of the main planting season.”

Inflation-adjusted revenue for the group climbed by 12% compared to the same nine-month period prior year and by 14% compared to the same quarter prior year, thanks to a volume rise.

Like any other firm, SeedCo Limited was not spared from the operational challenges emanating from power cuts, policy changes and exchange rate risks.

“Some of the major challenges the business is dealing with include the ongoing energy crisis, the lack of and high cost of fertilizers and agrochemicals, the loss in consumer purchasing power, and the shortage of liquidity in both local and hard currency,” it said.

“Positively, value was maintained in real terms during the business’s peak period of revenue generation because of the stability of the exchange rate and the increase in hard currency sales in Zimbabwe.”

In its outlook, the company said it will enhance stakeholder value along the entire value chain of the group in Zimbabwe and in the region – Harare