By ETimes

The local bourse fell for a fifth day on Wednesday, largely occasioned by the negative outing of heavyweight stocks.

Mining companies generally haven’t over-invested in new projects while demand for “green” metals is set to soar further.

While commodity prices have cooled for the most part in 2022 in line with the uncertain global environment, analysts say demand-supply dynamics are still favourable for mining companies in the long term because they haven’t over-invested in new capacity.

Analysts’ bullish outlook comes as the world looks to wean itself off environmentally damaging fossil fuels. They note that the transition to a green economy will spur demand for minerals such as copper and lithium.

Gold prices fell on Wednesday as a firmer dollar dampened greenback-priced bullion’s appeal for overseas buyers, while investors awaited the US jobs report to gauge the Federal Reserve’s policy tightening path.

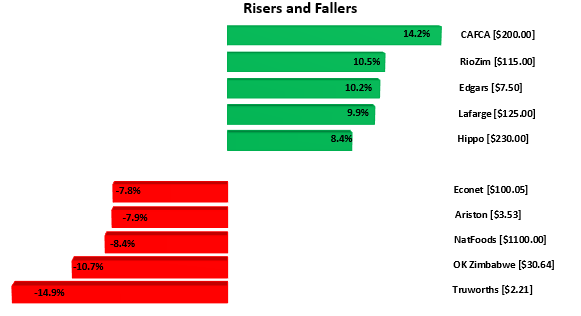

The bears’ camp-maintained dominance over the market breadth with 20 counters in the losers’ chart against 12 counters in the gainers’ chart. At midweek close, the ZSE All Share Index was 2.39% lower at 14,079.81 points.

CAFCA gained 14.29% to become the best performing stock in the session. The stock left its market capitalisation at $37.92 billion. Hippo added 8.44% to close at $230.00.

On the downside, NatFoods and Econet lost 8.41% and 7.88% to settle at $1100.00 and $100.05 respectively. Accordingly, the Top 10 Index was off 2.95% to 8,561.42 points.

The Medium Cap Index was down 1.14% to 28,861.48 points. Retail giant OK Zimbabwe eased 10.75% to end at $30.64, while horticulture exporter Ariston shed 7.95% to $3.53.

Conversely, RioZim, Edgars and Lafarge were up 10.58%, 10.29% and 9.94% to close at $115.00, $7.50 and $125.00 in that order.

The Small Cap Index recovered 1.26% to 494,604.57 points, although Truworths fell 14.97% to $2.21. The stock was the biggest faller for the day.

The market capitalisation declined by 2.76% to $1.74 million. The value of those traded stocks, on the other hand, inched up by 296.70% in the session to stand at $1.13 billion, as against a value of $286.68 million in the previous session.

With regard to the value of the traded stocks, Mash Holdings, with $662,028,633, took the lead among the top five performers. It is flanked by Delta, Econet, Simbisa and Innscor.

In the derivatives market, the Datvest ETF gained 0.48% to close at $1.7584. The Morgan & Co. Made in Zim was flat at $1.3000.

On the flip side, the Cass Saddle Agric ETF lost 12.80% to close at $1.8051, the Morgan & Co Multi-Sector eased 0.71% to $28.2972, and the OM ZSE Top-10 ETF shed 0.26% to $5.1867 – Harare