By ETimes

The stock market opened the week extending its losing streak for the fifth consecutive session despite positive earnings coupled with dividend declarations from several listed firms.

Accordingly, the mainstream ZSE All Share Index was off 2.33% to close at 12,384.96 points. Similarly, the market capitalization declined $38.99 billion to close at $1.51 trillion.

The local bourse has been closing on a negative note since last Tuesday, when the market capitalization declined to $1.68 trillion.

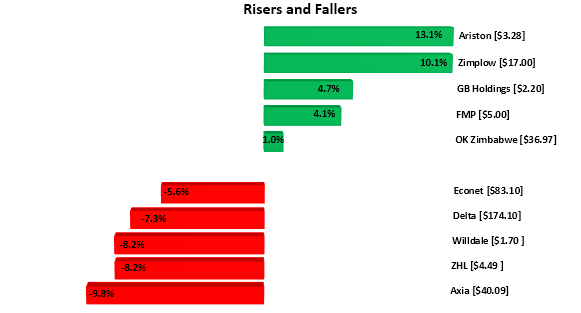

As measured by market breadth, market sentiment remained negative, as 13 stocks declined relative to 8 gainers. Axia led losers, declining by 9.86% to close at $40.09. Delta shed 7.31% to close at $174.10. Econet fell to $83.10, losing 5.65% in the process. This saw the Top 10 Index falling 3.56% to finish at 7,116.16 points.

Bucking the trend was OK Zimbabwe which added 1.37% to close at $36.97 and left its year to date gain at 34.72%. The retail giant was the most traded stock by volume and value at 3.34 million shares and $123.49 million respectively.

Horticulture exporter Ariston gained the most as it rose by 13.13% to close at $3.28 and left its market capitalization at $5.35 billion. Zimplow was up 10.15% to end at $17.00. FMP climbed 4.17% to close at $5.00. As a result, the Medium Cap Index rose 0.13% to settle at 28,585.03 points.

On the downside were ZHL and Willdale which eased 8.26% and 8.20% to finish at $4.49 and $1.70 in that order.

The Small Cap Index recovered 0.31% to close at 487,408.87 on GB Holdings which garnered 4.76% to finish at $2.20.

Market turnover increased 7.69% to $232.08 million in 269 trades.

The Cass Saddle Agriculture ETF, Morgan & Co Made in Zimbabwe and Morgan & Co Multi Sector were all flat. On the flip side, Datvest Modified Consumer Staples ETF lost 0.37% to close at $1.4910 while OM ZSE Top-10 ETF eased 6.33% to finish at $5.2560 – Harare