…delays further release of results

By ETimes

Clothing retailer Truworths says it has suspended all Zimbabwean dollar credit sales occasioned by the tight monetary regime.

This month, the apex bank decided to maintain the bank policy rate and medium-term lending rate at their current levels of 200% and 100%, respectively. It is poised to review interest rates in the first quarter of 2023 as dictated by inflation developments.

Businesses have been calling for interest rates to be lowered because they are stifling aggregate demand.

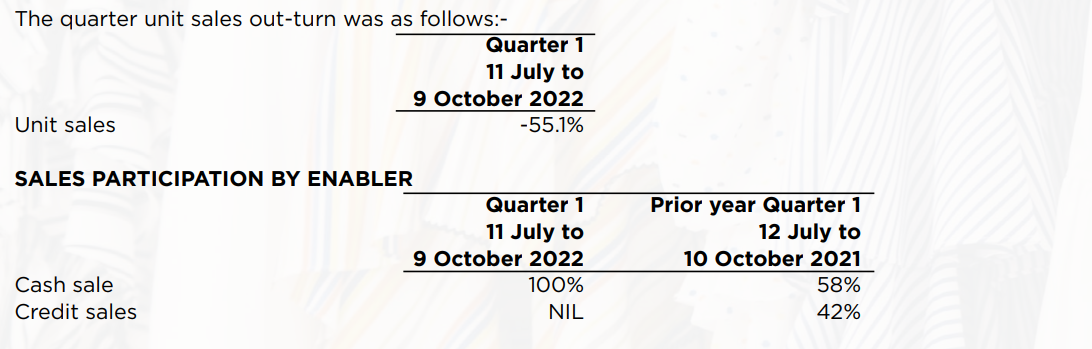

In a trading update for the quarter ended 9 October 2022, chief executive officer Bekithemba Ndebele said the trading environment has remained complex and uncertain.

“The increase of the Bank Policy Rate to 200% with effect from 1 July 2022 resulted in the business suspending all ZWL Credit Sales with a consequent reduction in units sold,” he said.

“ZWL Cash sales were negatively affected by the severe shortage of ZWL as a result of the tight monetary policy.”

Borrowings in ZWL totaled $56,35 million as of October 9, 2022, at a cost of 205% per year.

“There were no USD borrowings as at 9 October 2022 and there were no USD debtors,” he said.

Previously, the clothing retailer warned that its cash flows and profitability would suffer as a result of the official rate’s 20% retention on US dollar sales that are liquidated.

“Sales and profitability continue to be adversely affected by the restrictive pricing laws, which negatively affect competitiveness against the unregulated sectors,” he said.

“In addition to US dollar cash sales, the business is selling in US dollars on a lay bye basis. US Dollar credit is considered on a selective basis where there is assurance that the US dollar earnings are guaranteed and not an allowance.”

The firm requested and was given another extension by the Zimbabwe Stock Exchange so that the yearly audited results would be published no later than January 15, 2023.

In its outlook, the company expects the operating environment to remain challenging – Harare