By ETimes

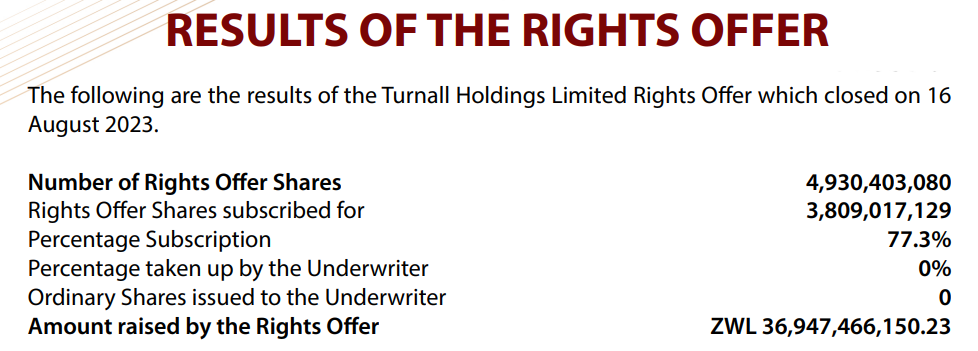

Turnall Holdings, a building material manufacturer, says it has raised $36.94 billion for recapitalisation through a rights issue of 3.8 billion shares.

Rights are typically offered by businesses when they need to generate money. These include when it’s necessary to settle a debt, buy equipment or purchase another business.

The expected investments would enable the group to retool and renovate its fibre cement sheeting lines and establish the Glass Reinforced Pipes (GRP) business after a number of trying years in which plant replacement and upgrading were not feasible due to numerous economic and operational obstacles.

“The two investment projects will significantly improve the profitability and cashflows of the group and increase the manufacturing capacity to meet the growing local and regional demand for its core products,” the firm said in a recent circular to shareholders.

“The investments will also result in reduced operational costs through improved key efficiencies such as reduced distribution costs locally and regionally due to Zimbabwe’s central location in Southern Africa.”

Turnall Holdings rights offer, which closed on 16 August 2023 was 77.3% subscribed.

On Monday, August 28, 2023, the new shares will be issued and listed on the Zimbabwe Stock Exchange, according to the company.

“Shareholders are advised that it was recorded in the Underwriting Agreement between the Company and the Underwriter that the Company intended to raise the Zimbabwe Dollar equivalent of US$8 million by way of the Rights Offer and the capital raise was underwritten on this basis,” reads the notice.

“At the time when the Turnall Holdings Limited Rights Offer Circular was published on 16 June 2023, US$8 million was equivalent to $47,824,909,876 but with the strengthening of the ZWL during the period of the Rights Offer the equivalent ZWL amount became ZWL36,456,000,000 by the time of the closing of the Rights Offer on 16 August 2023.”

The company said the underwriter was not obligated to subscribe for any shares of the company because the rights offer raised the ZWL equivalent of US$8 million.

“The Company has agreed with the Underwriter for no underwriting fees to be paid,” it said.

Turnall began the year with a share price of $3.9475 and has since gained 255% on that valuation, ranking it 36th on the ZSE in terms of year-to-date performance – Harare