By ETimes

HARARE – The demand for comparably more affordable US dollar loans will remain high, eventually accelerating the present dollarisation trend, IH Securities has warned.

The southern African nation has been fast dollarising, with official statistics revealing that more than three-quarters of transactions for food and goods purchases are now being done in US dollars.

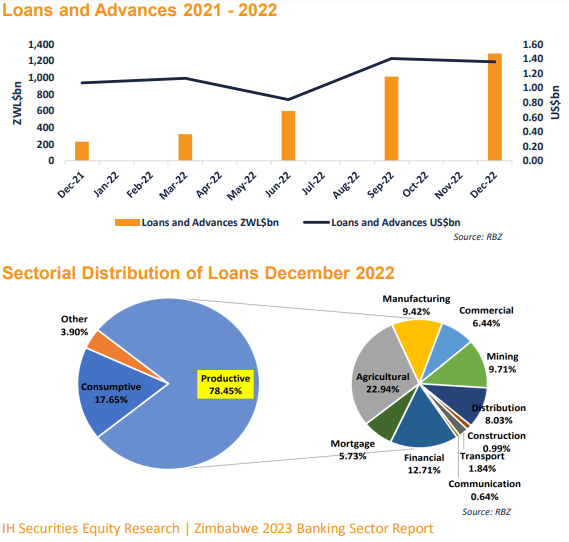

At the end of December 2022, lending to the economy’s productive sectors accounted for 78.45% of all loans made by banks, up from 76.29% at the end of the previous year, according to the IH Securities 2023 Banking Sector Report. This is a 2.16 percentage point gain.

The objective is to give businesses long-term financing so they may increase their production capacity and export more, therefore earning foreign currency.

“Given prohibitive ZWL interest rates and reduction of the USD IMTT, demand for relatively better priced USD loans will likely remain elevated inevitably deepening the current dollarization trend,” IH Securities stated.

An estimated US$1.5 billion to US$2 billion is moving about in the unorganised sector.

Over 70% of Zimbabwe’s gross domestic product (GDP) or household foreign currency savings come from the country’s informal sector.

“The banking sector is seeing a shift of earnings towards hard currency as the economy increasingly dollarizes,” reads the report.

“Banks however remain cautious in light of the volatile operating environment with tenures going up to a maximum of 3 years for other loans and fixed income instruments and up to 5 years for retail mortgages versus 30 years in developed countries.”

IH asserts that due to a hyperinflationary climate, nominal profitability as assessed by return on equity and return on assets stays high in comparison to rivals.

In reality, profitability is lower than that of peers and may continue to decline as costs increase.

Advertisement