By ETimes

…as Equities extends negative outlook

The Zimbabwe Stock Exchange (ZSE) extended its negative trend for the eleventh day in a row, as the ZSE All Share Index fell 0.93% to close at 13,808.13 points.

Consequently, market capitalisation took the direction of the mainstream index as it slid by $11.56 billion to $1.65 trillion.

The latest African Financials report shows that Swissport Tanzania Plc topped the list after appreciating by 1130% to US$1 million. Banking counter ZBFH followed with a 555.7% gain to US$22 million. FBC, First Capital Bank and CBZ were also ranked among the companies with the highest US dollar earnings increases in the first half of 2022.

Mid-tier stock Dairibord made it to the Top 10 list.

The 2022 earnings of 11 countries out of 13 in the report are up from H1 2021, according to the report. The country topped the list, rising by 253% to US$111 million in terms of US dollar earnings by market. It was followed by Mauritius, which climbed by 115% to US$48 million.

“There is a negative correlation between earnings growth and share price performance,” reads the report.

“Although 72 companies have increased their earnings in US dollar terms, 45 companies have seen their share prices fall during 2022.”

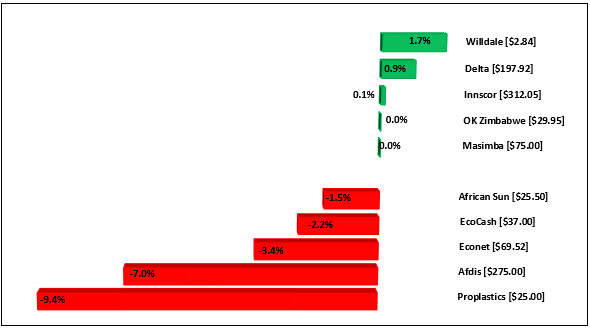

Also, market breadth closed negative with 12 losers while five stocks appreciated in price. Losses in Econet and EcoCash saw the Top 10 Index fall by 1.41% to close at 7,826.89 points. Econet fell 3.41% to end at $69.52. EcoCash was 2.29% lower at $37.00.

On the other hand, Delta rose 0.91% to close at $197.92 after declaring an interim US dollar dividend. Innscor garnered 0.13% to finish at $312.05.

Proplastics led the losers’ chart by 9.42%, to close at $25.00, per share. Afdis followed with a decline of 7.09% to close at $275.00, while African Sun went down by 1.58% to close at $25.50.

The Medium Cap Index was up 0.02% to close at 32,952.75 points.

Conversely, OK Zimbabwe added 0.04% to close at $29.95. Construction firm Masimba was slightly flat at $75.00.

The Small Cap Index was off 0.98% to close at 511,208.46 points on Willdale, which led the gainers’ table, appreciating by 1.73% to close at $2.84.

Turnover for the day rose 384% to $800.65 million. Transactions in the shares of Masimba topped the activity chart with 6,223,900 shares valued at $466,792,900.

On the VFEX, there were no trades.

The Datvest ETF gained 0.09% to close at $1.6185. On the flip side, the OML ETF eased 11.91% to end at $5.55. Others were virtually flat – Harare