By ETimes

The Zimbabwe Stock Exchange ended Friday’s trading session in negative territory despite the fact that the holding term for shares subject to the 40% Capital Gains Tax has been lowered by the Treasury from the originally proposed 270 days to 180 days.

Accordingly, the ZSE All Share Index dipped 0.84% to close at 13,631.44 points. Market breadth closed at par with 14 gainers and 14 losers.

The Top 10 Index lost 1.11% to close at 8,139.72 points on Econet which eased 3.92% to $106.28.

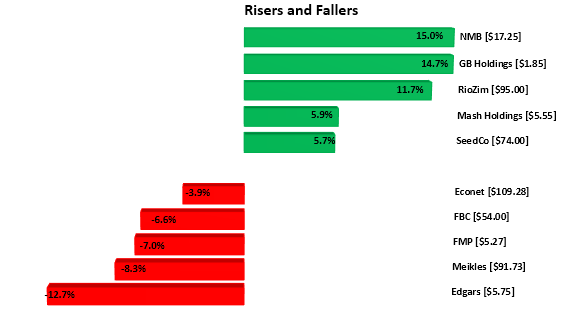

Banking counter NMB was the best performing stock today. The stock increased 15% to close at $17.25, bringing its year-to-date gain to 114.20%.Mash Holdings and SeedCo were up 5.92% and 5.70% to finish at $5.55 and $74.00, respectively.

On the other hand, Meikles, FMP, and FBC eased 8.30%, 7.07%, and 6.65% to trade at $91.73, $5.27, and $54.00 in that order. This saw the Medium Cap Index fall 0.20% to close at 29,091.02 points.

Clothing retailer Edgars was the worst performing stock, declining by 12.71% to end at $5.75. As a result, the Small Cap Index suffered the most, losing 2.14% to close at 489,494.86 points.

Bucking the trend was GB Holdings, which gained 14.78% to $1.85.

Gold miner RioZim was up 11.77% to $95.00.

Turnover stood at $247.49 million, mainly coming from Innscor at $126.31m, OK Zimbabwe at $62.71m and Delta at $13.59m. The market cap fell $345.08 million to $1.7 trillion.

Foreign investors were net sellers after disposing of $2,200 against buys of $0.00.

The Cass Saddle Agric ETF, Datvest ETF, and Morgan & Co Multi-Sector were both flat. The OM ZSE Top-10 ETF gained 0.21% to close at $5.6300. On the downside was Morgan & Co Made in Zim, which plunged 2.40% to $1.2200 – Harare