…as ZWL marginally slides against USD

On Tuesday, equities trading at the Zimbabwe Stock Exchange ended bullish to halt one day’s negative outing. The All Share Index therefore inched up by 0.02% to stand at 13,772.01 points.

The Zimbabwean dollar depreciated by a marginal 1.11% against the greenback to $646.24 at Tuesday’s weekly auction.

But, with the gap between the official and black-market exchange rates closing, the local currency is displaying indications of stabilization, giving rise to optimism that Zimbabwe’s runaway inflation may slow.

At the end of the day’s trading session, equities investors earned $459.96 million as the market capitalisation followed suit the direction of the ASI to stand at $1.65 trillion.

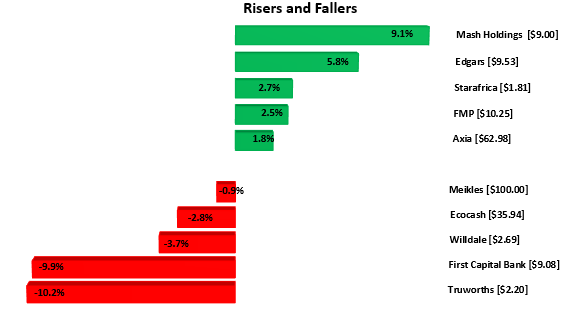

The session yielded 17 gainers and 9 losers.

The Top 10 Index was off 0.11% to close at 7,809.52 points on Ecocash which eased 2.81% to end at $35.9479.

Chams gained 9.11% to become the best performing stock in the session closing at $9.00. Starafrica was up 2.78% to $1.81. FMP gained 2.50% to $10.25 while Axia added 1.88% to close at $62.98. As a result, the Medium Cap Index gained the most, up 0.32% to 32,851.85 points.

On the flip side, First Capital Bank eased 9.92% to $9.08. Meikles fell 0.99% to $100.00.

The Small Cap Index lost 1.47% to 504,759.97 points. Truworths led the losers’ chart by 10.20% to $2.20. Brick maker Willdale was down 3.73% to $2.69.

Market turnover rose 9.26% to $1.27 trillion – Harare