By ETimes

The Zimbabwe Stock Exchange fell further on Thursday, extending its losing streak to six consecutive trading sessions.

At close, the mainstream ZSE All Share Index shed 1.41% to close at 14,734.58 points. In the same vein, market capitalisation was down $23.73 billion to $1.75 trillion.

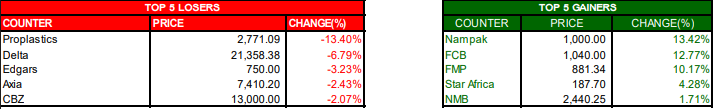

The Top 10 Index was off 2.23% to close at 8,367.03 points. Among the heavyweights, Delta eased 6.78% to close at $213.58. Axia fell 2.35% to $74.10 while CBZ slid by 2.07% to $130.00.

Mid-tier stock Nampak suffered the most as it plunged 13.42% to $10.00. First Capital Bank succumbed by 12.77% to $10.40. FMP fell 10.17% to $8.81. Starafrica added 4.28% to $1.87. Banking counter NMBZ gained 1.71% to close at $24.40.

The Medium Cap Index was up 0.40% to settle at 33,654.35 points.

On the other hand, Proplastics led the losers table by 13.40% to end at $27.71.

The Small Cap Index retreated by 0.05% to 518,532.80 points on Edgars, which fell 3.23% to close at $7.50.

Market turnover fell from $54,77 million yesterday to $506,70 million in 1.97 trades.

On the VFEX, SeedCo International shed 13.23% to close at US$0.31. Other stocks remained flat.

The Morgan & Co Made In Zimbabwe ETF gained 0.9% to $1.1200. On the flip side, Datvest ETF lost 2.04% to $1.6655 while OML ETF shed 1.71% to $5.1999.

Trading Updates

On the back of real business growth, ZHL Group’s inflation-adjusted total income increased 193% in the nine months to September 2022.Reinsurance and life and pensions business operations contributed 53% and 35%, respectively.

The positive performance of the reinsurance business segment in inflation-adjusted terms was driven by new business acquisition and high renewal rates.

Total claims and expenses increased by 56 percent in inflation-adjusted terms due to higher claims experiences in agriculture and cyclone related claims and high operating costs recorded by local entities due to inflationary pressures currently obtaining in the economic environment.

The company turned a profit in inflation-adjusted terms after suffering a loss the previous year.

In the outlook, the group will continue to pursue its business growth triangle, with more focus placed on strong cash generation.

Fidelity Life has projected to finish the year on a positive trajectory as it responds to unfolding market trends to offer the appropriate products, services, and solutions to clients.

Inflation-adjusted, the group’s total core revenue increased by 100% in the nine months to September 2022.According to the group, core revenue was driven by the life assurance businesses, which contributed 82% of the group’s total core revenue. This was underpinned by growth in individual life business due to an increase in the uptake of the Vaka Yako investment product premiums, aggressive premium reviews, and employee benefits premium income growth as a result of salary increases, indexed business, and foreign currency denominated products.

The Group’s total income for the nine months to September 2022 increased by 393% in inflation-adjusted terms, occasioned by premium income, fair value adjustments from investment property, and equities. The group’s profit for the period grew by 1532% in inflation adjusted terms – Harare