By ETimes

The local bourse opened the week negative, extending its losing streak for the third consecutive session as investors’ investment declined by $7.14 billion.

The ZSE announced that the disposal of securities within 180 days from the date of purchase will attract a Capital Gains Tax Rate (CGTR) of 40 percent on the assessed gain.

In the coming week, anticipation is that there will be a subdued buying momentum that may lead to lower stock prices.

The mainstream ZSE All Share Index lost 0.42% to close at 15,051.42 points. Market capitalisation declined by $7.14 billion to $1.82 trillion.

A negative market breath – a measure of investors’ sentiment – was registered as 15 counters traded in the red against 9 gainers.

Among the heavyweights, Econet put on 0.27% to $87.00 while Innscor added 0.02% to $340.51. On the flip side, Simbisa was down 1.87% to $235.80 while Delta fell 1.06% to $237.21 and Ecocash eased 0.82% to $41.74.

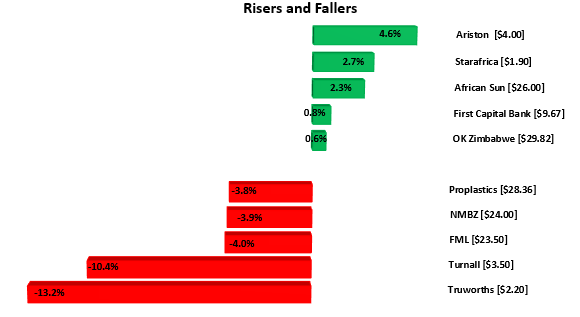

Horticulture exporter Ariston led the risers gaining 4.62% to close at $4.00. Sugar producer Starafrica was 2.70% higher to $1.90.

Hotelier African Sun was up 2.36% to end at $26.00. First Capital Bank gained 0.80% to close at $9.67. Retailer OK Zimbabwe added 0.63% to close at $29.82.

Losses were recorded in FML, NMBZ and Proplastics which eased 4.08%, 3.99% and 3.84% to settle at $23.50, $24.00 and $28.36 respectively.

Clothing retailer Truworths was the worst performer. The stock was down 13.29% to close at $2.20. Turnall lost 10.49% to $3.50.

Market turnover declined from $205.27 million to $152.39 million. Delta was the most actively traded stock today. A total of 331,800 shares valued at $78,707,415 were traded.

On the Victoria Falls Stock Exchange, only Padenga traded, gaining 1.53% to $0.24.

The Datvest ETF was up 0.05% to $1.7479 while the OML ETF gained 12.49% to $5.86. Other ETFs were virtually flat.

Oil prices were stable on Monday, hovering close to US$100 a barrel as support from a weaker dollar and recovering Chinese crude imports met renewed demand concerns linked to China’s stringent Covid-19 containment approach.

Brent crude futures rose by US6c, or 0,06 percent to US$98.63 a barrel, as the US West Texas Intermediate crude was at US$92.60 a barrel, down US1c, or 0,01 percent.

Both contracts dropped by over US$1 per barrel earlier in the session as Chinese health officials on the weekend reiterated their commitment to a stringent Covid-19 containment approach, dashing hopes of a rebound in oil demand from the world’s top crude importer.

Gold prices slipped on Monday from a three-week high scale in the previous session, as the US dollar regained some ground, making greenback-priced bullion more expensive for holders of other currencies.

Spot gold was down 0,4 percent at US$1 672.99 per ounce as bullion prices surged 3 percent on Friday and the dollar fell nearly 2 percent after US jobs data raised hopes about the Federal Reserve being less aggressive on rate hikes in future.

US gold futures were flat at US$1 676.30 – Harare