By ETimes

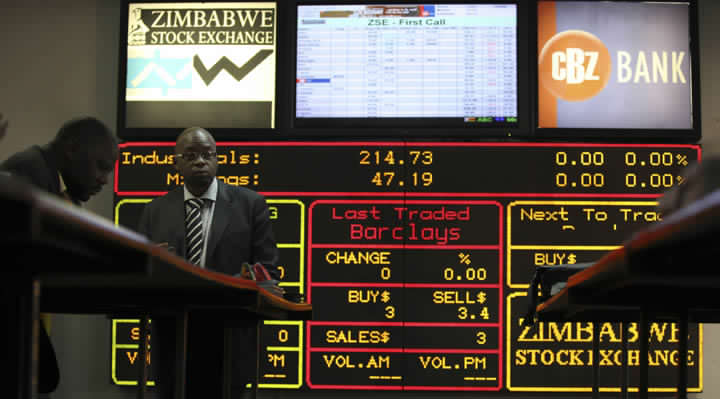

HARARE – The first trading session of the new week on the Zimbabwe Stock Exchange closed on a positive note today after trading 5.23% higher.

As measured by market breadth, market sentiment was positive, as 11 counters gained relative to 3 losses.

Market capitalisation rose 7.72% to $10.36 trillion. In tandem with market capitalisation, the mainstream ZSE All Share Index gained 5.23% to close at 133,270.45 points.

A total of 908,500 shares worth $980.42 million were exchanged in 192 deals.

The Top 10 Index appreciated by 7.80% to end at 60,971.85 points.

On the price movement chart, NMB was the highest price gainer, appreciating by 15% to settle at $247.90 and was trailed by Delta, which gained 14.85% to finish at $2,636.52.

OK Zimbabwe appreciated by 14.04 to sell for $136.96, FML rose by 12.29% to trade at $245.00, and Turnall appreciated by 7.50% to quote at $23.64.

On top of the losers’ chart at the close of transactions on Monday was GB Holdings, which went down by 13.04% to close at $10.00.

Tanganda lost 0.03% to finish at $912.75 and FMP decreased by 0.02 to trade at $124.93.

The most traded stock on the market today was Delta, which transacted 315,800 shares valued at $832.61 million and was trailed by FBC, which transacted 61,400 units worth $49.12 million.

Today’s performance comes as the United States Agency for International Development (USAID)’s food security arm, the Famine Early Warning Systems Network (Fewsnet), revealed that by the end of September, several essential food product ZWL prices had risen by nearly 20% as compared to August, following rises in the parallel and official market exchange rates of roughly 15 and 18%, respectively.

“The official and parallel market exchange rate increases follow nearly two months of decline and relative stability. At the end of September, the ZWL traded at 5,383 ZWL at the interbank rate and nearly 7,000 ZWL per USD on the parallel market,” it said.

“However, USD and ZAR prices in the informal markets remain stable, and these markets are the main source of goods for most households. However, staple grain prices are expected to increase seasonally as demand increases through the lean season, especially in deficit-producing areas.”

The lack of grain in some of these areas and the increase in cereal grain prices are expected to increase poor households’ reliance on maize meal, Fewsnet added.