By ETimes

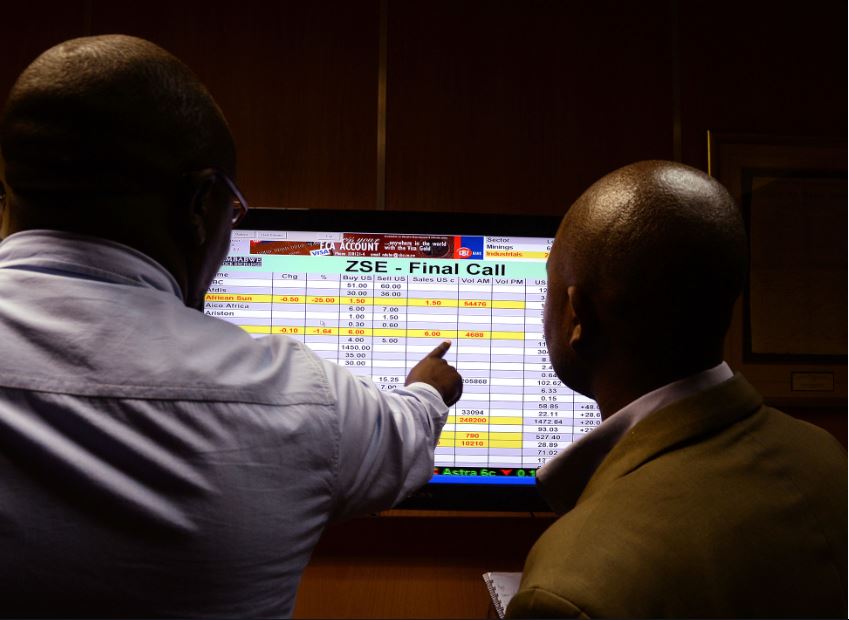

The Zimbabwe Stock Exchange opened the week on a negative note, shedding $108.6 billion due to losses in largely capitalised stocks as investors in a wait-and-see mood consider taking profit from counters that have rallied recently.

In the same vein, the mainstream ZSE All Share Index lost 1.03% to close at 175,576.09 points.

The overall market capitalisation value lost $108.6 billion to close at $14.19 trillion from 14.3 trillion.

Market observers expect to see a gradual reduction in activity in the market as the 2024 national budget announcement draws nearer.

As measured by market breadth, market sentiment was positive, as 6 stocks lost relative to 12 gainers.

Losses in CBZ and Delta saw the Top 10 Index decline 2.09% to 75,480.60 points.

Conversely, the Medium Cap Index was up 1.19% to finish at 757,489.02 points.

The Small Cap Index suffered the most as it plunged 7.53% to end at 4,940,908.07 points.

In 204 deals, investors exchanged 13.06 million shares valued at $708.64 million.

Transactions in the shares of Delta topped the activity chart with 36 500 shares valued at $116.93 million. Dairibord followed with 185 900 shares worth $101.5 million.

Morgan & Co Made In Zimbabwe added $0.1563 to $7.3563. Old Mutual Top 10 ETF was $0.0800 higher at $32.0936.

Morgan & Co Multisector ETF, Datvest Modified Consumer Staples ETF and CASS Saddle Agriculture ETF remained flat at $360.0000, $8.0000 and $7.5000 respectively.

Tigere REIT added $4.4497 to $254.9597.

On the VFEX, Padenga topped the gainers chart, up 20% to US$0.1800. Axia followed, up 11.94% to close at US$0.0750. Simbisa completed the list of gainers, notching up 1.39% to end at US$0.3557.

On the flip side, SeedCo International lost 0.39% to finish at US$0.1753-HARARE