By ETimes

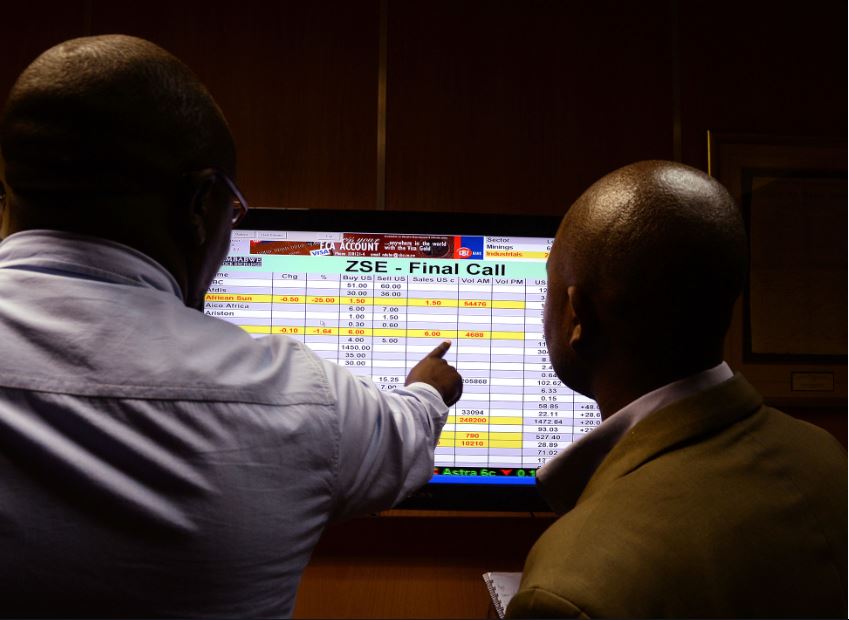

The Zimbabwe Stock Exchange (ZSE) resumed after the Easter public holidays on Tuesday with a loss of 1.19% due to profit taking.

This comes as the International Monetary Fund has projected the country’s economy to grow by 2.5% in 2023. However, this is far below the 3.8% that was predicted by authorities.

In 2024, the southern African nation’s GDP is poised to be 2.6% in 2024.Specifically, the All-Share Index lost 456.56 points or 1.19 % to close 37,919.08 points while market capitalisation declined $35.81 billion to $3.11 trillion.

The Top 10 Index depreciated by 2.16% to close at 22,100.15 points. Ecocash was the worst performer, down 8.73% to close at $60.80. Econet followed, plunged 8.57% to end at $215.28.

The Top 10 Index depreciated by 2.16% to close at 22,100.15 points. Ecocash was the worst performer, down 8.73% to close at $60.80. Econet followed, plunged 8.57% to end at $215.28.

OK Zimbabwe was 4.19% lower at $62.68.The Medium Cap Index jumped 1.69% to close at 80,260.52 points.

Masimba and CFI led the gainers table, up 15% apiece to close at $166.75 and $677.10 respectively.

Proplastics gained 10% to end at $110.00. FML and Mash Holdings added 8.65% and 7.14% to finish at $22.27 and $15.00 respectively.

On the other side of the coin, Tanganda fell 3.28% to $338.52. RTG eased 2.25% to settle at $16.61.

Investors traded 1.7 million shares worth $328.09 million in 268 deals, compared with 1.78 million shares worth $372.56 million transacted in 163 deals previously.

Econet led the volume chart with 464,900 units as well as the value chart with deals worth $100.08 million.

Morgan & Co Made In Zimbabwe ETF gained 0.14% to $1.9357.Old Mutual ZSE Top 10 fell by 4.29% to $10.4500.

Cass Saddle Agriculture ETF declined 0.30% to $2.0462.There was bloodshed on the VFEX. BNC lost 3.04% to US$0.0191. National Foods was down 0.95% to US$1.8022.

Innscor Africa Limited depreciated by 0.15% to close at US$0.6488. Axia plunged 0.09% to US$0.1019. Simbisa eased 0.09% to US$0.0004 – Harare

Place your advert at affordable rates