…reports 250% rise in full year net profit

By ETimes

The Zimbabwe Stock Exchange (ZSE) for the year ended December 31, 2022, recorded a profit of $352,9 million, a 250% increase compared to $100.9 million booked the prior comparable year.

Amid the challenging operating environment characterised by exchange rate volatility and policy inconsistencies, the local bourse indicated that it reported an overall improved financial performance.

“Failure to increase income at a quicker rate than costs resulted in reduced profit margins despite an absolute increase in profit,” ZSE said in its 2022 annual report.

Total inflation adjusted income increased by 42% to $2.01 billion, boosted by a growth in listing fees.

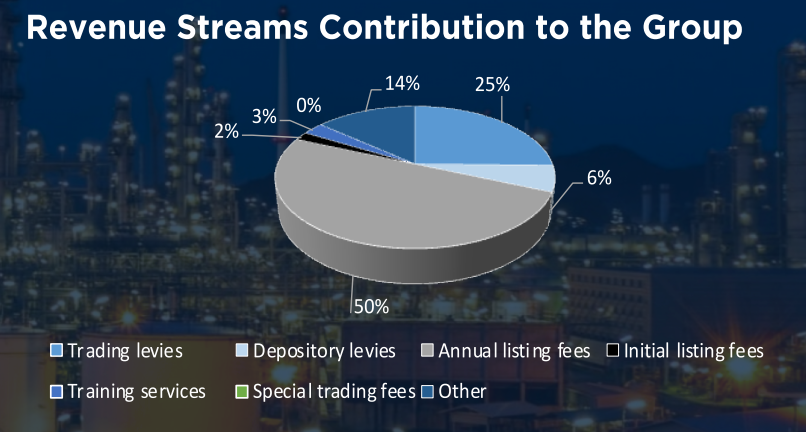

“Listing fees contributed 52% and trading levies contributed 25% to the group total income due to tight liquidity in the economy and stringent measures placed on the stock market to manage inflation.”

As expected, due to inflationary pressures in the market, operating expenses jumped 76.98% to $2.16 billion.

“Staff related costs were the largest driver of operating expenses in the period under review, contributing 46% of the operating expenses. The rapid growth in staff costs reflect on an inflationary environment which demands companies to constantly review payroll costs to cushion staff,” ZSE stated.

Cash generated from operations improved to $237.9 million.

The Group committed $327.1 million to capital expenditures and $715.5 million in financial instruments to diversify financial risk.

Presently, the VFEX continues to entice top-performing businesses, giving Zimbabwean businesses much-needed trust in the country as a secure investment location.

“We expect to expand ZSE Direct and VFEX Direct through partnerships with banks and other capital market operators, which should result in increased usage of the platform,” it said.

The local bourse expects a gloomy outlook to cloud the country.

“It is likely to be another difficult year for Zimbabwe given the high inflation, weak domestic currency, increasing poverty levels, declining living standards, slowing consumer disposable incomes, low savings rate, electricity and energy shortages, climate and natural induced shocks.

“The significant depreciation of the local currency and consequently high inflation will likely drive any excess ZWL liquidity to buy assets on the exchange,” the group said in its outlook.

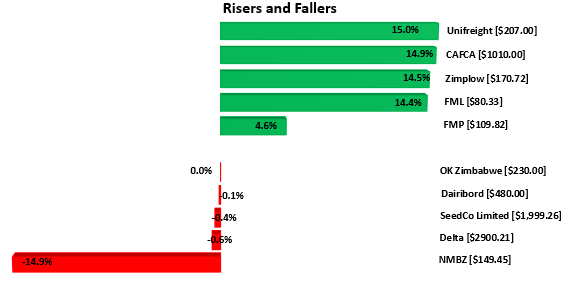

As measured by market breadth, Friday’s market sentiment was positive, as 13 tickers gained relative to 6 losers.

On the performance board, Unifreight recorded the highest gains of the day, having appreciated in share value by 15% while NMBZ topped the losers’ list as their respective share prices dipped by 14.99%.

A total of 8.84 million shares valued at $3.57 billion were traded.

Mash Holdings led the volume chart with 6.66 million shares traded, while Delta led the value chart in deals worth $2.04 billion.

OML ETF was the only gainer, gaining 2.24% to close at $41.8851.

On the downside, the Cass Saddle Agriculture ETF fell 7.69% to close at $4.4028. Morgan & Co Multi Sector ETF eased 0.36% to end at $135.0000. Datvest ETF went down 0.25% to $12.2431.

Morgan & Co Made In Zimbabwe ETF was flat at $6.4000.

On the VFEX, Innscor Africa Limited added 2.36% to US$0.4500. In the red were Axia and Padenga, which depreciated by 11.11% and 5.25% to close at US$0.0800 and US$0.2056 respectively – Harare

Advertisement