By ETimes

The bullish run in the stock market occasioned by the release of half year results continued in the week’s opening but under weak activity as the liquidity crunch continues to depress the market. As a result of the bull’s rampage, the mainstream ZSE All Share rose 8.21% to close at 12,584.17 points.

Today’s performance comes as Inflation slowed marginally to 280.4% in September from 285% in August, according to the latest official figures, while September month-on-month inflation was 3.5%, from August’s 12.4%. A slowdown in the rise of food prices aided the ease in inflation in September.

Previously, the treasury said it is implementing the necessary policy measures to ensure that inflation is back on the single digit desired path.

At close, the Top 10 Index gained the most, rising 10.83% to close at 7,415.12 points.

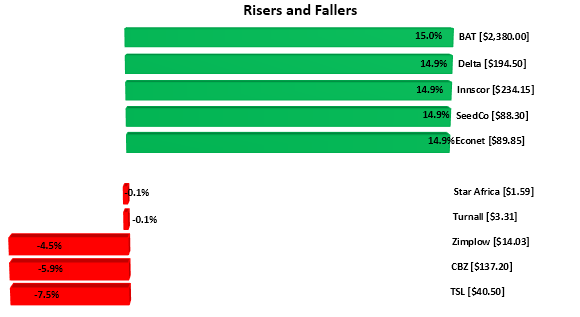

Cigarette manufacturer BAT led advancers, appreciating by 15% to close at $2380.00. Delta added up 14.99% to finish at $194.50. Innscor was up 14.98% to end at $234.15. Econet gained 14.97% to settle at $89.85.

On the flip side, banking counter CBZ lost 5.90% to end at $137.20.

The Medium Cap Index recovered 3.12% to close at 27,576.97 points on SeedCo which climbed up 14.97% to finish at $88.30.

TSL topped the losers’ chart, declining by 7.53% to finish at $40.50. Zimplow eased 4.51% to $14.03. Star Africa slumped to$1.59, recording 0.12% slip.

The Small Cap Index gained 3.39% to 487,763.98 points, although Turnall closed at $3.31, going down by 0.15%.

In 225 deals, investors exchanged 1.72 million shares valued at $35.40 million. African Sun, Masimba and OK Zimbabwe were actively traded stocks on the local bourse.

Market capitalization increased by $129.76 billion to $1.54 trillion.

Majority of ETFs closed in the positive territory. The Datvest gained 2.96% to close at $1.4971 while the Morgan & Co Made in Zim garnered 4% to $1.3000. Also, the OM ZSE Top-10 rose 11.42% to $4.7014.

The Cass Saddle Agric and Morgan & Co Multi-Sector were both flat at $2.0000 and $27.7324 respectively-HARARE