By ETimes

It was not cheery news on the trading floor of the Zimbabwe Stock Exchange (ZSE), as activities on the stock market took a negative turn on Thursday.

The mainstream ZSE All Share Index fell by 0.61% to close at 27,755.81 points. The loss was strong enough to cancel the gains from the previous session.

The Top 10 suffered the most, as it plunged 1.28% to close at 16,714.69 points. Among the heavyweights, Delta plunged 5.02% to close at $513.61.

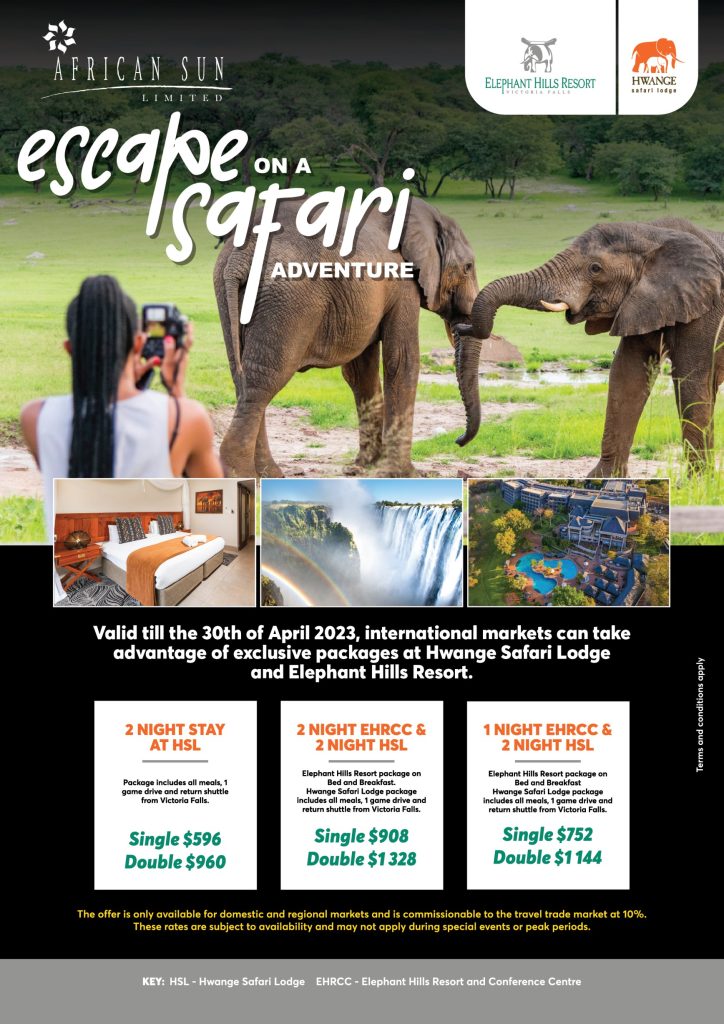

Gains in African Sun and Ariston lifted the Medium Cap Index as it recovered 0.89% to close at 59,503.06 points. African Sun gained 9.45% to close at $78.77, while Ariston added 8.47% to finish at $6.00 ahead of its AGM.

SeedCo Limited climbed by 2.44% to end at $194.65. The company said it will remain listed on the ZSE.

“Shareholders of Seed Co Limited and the investing public are advised that the board has resolved to suspend indefinitely the proposal to migrate the company’s listing from the ZSE to the Victoria Falls Stock Exchange.

“Accordingly, the cautionary announcement made on 18 January 2023 is hereby withdrawn,” the company said in a statement.

FMP topped the losers’ chart, declining by 11.76% to close at $15.00. NMB shed 6.82% to end today’s trade at $42.02. First Capital Bank fell to $17.72, losing 6.39% in the process. Zimplow slumped to $29.77, recording 6.22% depreciation.

Zimpapers led gainers, appreciating by 15% to close at $5.75. Turnall grew 14.78% to end trading at $6.60. NTS went up by 7.84% to $11.00. As a result, the Small Cap Index was up 6.59% to close at 618,315.47 points.

Market capitalization declined by $17.96 billion to $2.95 trillion. Turnover for the day increased by 284.85% to $653.24 million.

Morgan & Co Made In Zimbabwe ETF gained $0.0017 to $1.4200 and Datvest Modified Consumer Staples ETF increased by $0.0820 to $1.8944.

The Old Mutual ZSE Top 10 fell $0.0045 to $8.9955, the Morgan & Co Multi Sector ETF fell $0.1192 to $21.7023, and the CASS Saddle Agriculture ETF fell $0.1974 to $2.2126.

Tigere REIT added $0.7839 to end at $49.4439.

Meanwhile, President Emmerson Mnangagwa declared that the government is dedicated to paying off the country’s outstanding external debt, which has prevented it from obtaining new financing from international financial institutions.

“This initiative highlights my government’s commitment to clear our outstanding debt arrears, including those to the African Development Bank Group, other multilateral institutions, and bilateral creditors,” Mnangagwa said during a meeting with international creditors in the capital.

“Zimbabwe’s debt overhang continues to weigh down heavily on our development efforts. We have no access to new lines of credit, including from the multilateral banks, such as the World Bank Group.”

In September 2022, Zimbabwe’s external debt was US$14.04 billion, up from roughly US$8 billion in 2019. US$6.3 billion of this total is due in arrears.

Zimbabwe owes the World Bank US$1.48 billion, the African Development Bank US$671 million, the European Investment Bank US$372 million, the Paris Club US$3.55 billion and the non-Paris Club US$2.22 billion, respectively. Bilateral creditors, multilateral creditors, blocked funds, Treasury bonds, and other creditors are allowed the remaining amount – Harare