By ETimes

Financial Performance Highlights

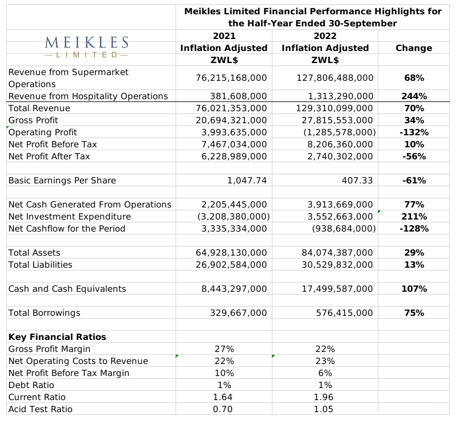

Listed hospitality and retail group Meikles Limited reported an inflation adjusted Net Profit After Tax of ZWL$2.7 billion for its half year ended 30 September 2022. The performance was a 56% decline from the 2021 comparative.

Exchange and monetary gains of ZWL$2.9 billion and ZWL$6.8 billion contributed significantly to the group’s financial performance. Otherwise, net operating profits fell by 132% to a loss of ZWL$1.28 billion, while gross profits gained 34% to ZWL$27.8 billion.

The group’s total revenues stood at ZWL$129.3 billion. The supermarkets segment recorded revenue growth of 68% to ZWL$127.1 billion. Sales volumes grew by 38.5% during the first quarter of the period, but declined by 4.4% in the second quarter to leave overall growth at 15.46%. The group attributed the decelerated growth to reduced consumer spending due to the restricted ZWL liquidity.

The hospitality segment reported revenue growth of 244% to ZWL$1.3 billion, as room occupancy increased from 12.9% to 32.5% during the period.

The group’s operations generated net cashflows of ZWL$3.9 billion, and net capital expenditures for the period stood at ZWL$3.6 billion.

Total assets stood at ZWL$84.1 billion, with cash holdings of ZLW$17.5 billion and inventories of ZWL$18.7 billion. Total liabilities stood at ZWL$30.5 billion, with borrowings of ZWL$576.4 billion and trade payables of ZWL19.7 billion.

The group supermarkets segment saw its inflation adjusted profits decline by 3% to ZWL$2.9 billion during the half-year. A new outlet was opened during the period at recently opened Highlands shopping center. The hotels segment recorded a 161% rise in profits to ZWL$1.04 billion.

Looking ahead, the group expressed confidence in the adequacy of its financial resources to see out planned capital projects across its subsidiaries. Works are ongoing for the opening of three new stores planned for the first quarter of next year. The first phase of hotel refurbishments was completed during the period. The group also commenced refurbishments on its Robert Mugabe Road property during the period, and expects to complete the project in the first quarter of next year. Further refurbishments of all remaining properties is expected in the next financial year.

The group declared a dividend of USc0.25 per share payable on the 15th of December 2022.

Commentary and Analysis

Its a set of financial results that highlights the short-term dangers facing the group. Beyond the dampened consumer sentiment, exchange rate related price distortions are likely to drive consumers to informal markets. This will likely constrain the group’s US dollar takings, which may be a concern given the group’s significant trade payables. It could require the group to focus more of its financial resources on maintaining working capital rather than capital investments. In the circumstances, it does raise some slight concern that the group opted to declare a US dollar dividend. The ongoing electricity supply disruptions are also likely to pressure the group’s profit margin margins. So, its a depressed short-term outlook for the group’s core supermarket operations. Additionally, the domestic political uncertainty and depressed global economic outlook stand to constrain the group’s hospitality operations. Looking long-term, the group continues to aggressively grow its geographic footprint in the supermarket sector. Industry rival OK-Zim tends to offer a wider range of value added customer services, this could be an area to address as the competition heats up.

On the ZSE, since the start of 2022, the Meikles share has lost 20% in nominal terms and 87% in implied US$ terms. The share is currently trading at a price to book ratio of 0.7x- Harare