By ETimes

Volumes, a key indicator of demand, for Afdis in the half year ended 30 September 2022 rose 11% in the comparative period despite a challenging operating environment.

One of the main challenges facing companies serving in the domestic market is preserving value against the rapidly devaluing exchange rate. Afdis challenges are amplified by its reliance on foreign suppliers to sustain its operations.

Chairman Matlhogonolo Valela, in a statement accompanying the results, said the rising inflation, high interest rates, and supply chain disruptions made the trading environment during the time under review difficult.

“The government introduced initiatives to reduce ZWL$ liquidity and stabilise the exchange rate in the first quarter. The reduction in ZWL$ liquidity resulted in the softening of demand for goods and services in supermarkets whilst increasing US dollar transactions in general trade,” he said.

In the period, wine volume went up by 24%, backed by improved availability and affordability of some brands, which are now packaged locally.

Spirit and Ready to Drink CRTD) volumes rose 9% and 11%, respectively, due to a renewed focus on direct sales distribution.

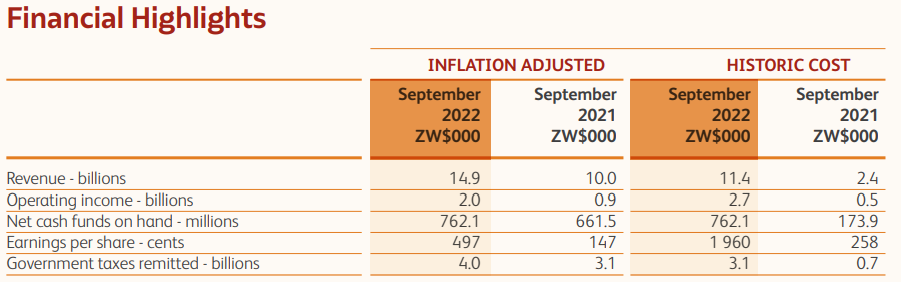

Inflation adjusted revenue increased by 48% to $14.9 billion, while operating income surged by 128% to $2 billion.

“Revenue growth in both inflation and historical terms was due to higher volume, favourable nix and replacement cost-based pricing while operating profit increased due to cost management and improved margins.”

Profit for the period increased by 233% to $584.49 million from $175.15 million in the comparative period last year.

In the outlook, he said: “The operating environment is set to remain challenging, with uncertainty on power supply and inflation”.

“There are, however, opportunities for growth anchored on increased economic activity resulting from mining, agriculture, infrastructure projects, the forthcoming elections and relaxed Covid-19 restrictions.”

The board has recommended an interim dividend of US$0.0025 per share, amounting to US$299 thousand – Harare