By ETimes

Lafarge Cement Zimbabwe met its set deadline of publishing half year results before the end of October 2022 after being delayed on account of new external auditors’ review work.

Following the Zimbabwe Stock Exchange’s extension of time to the company, the interim financial results that were scheduled to be released on or before 30 September 2022 will now be released on or before 31 October 2022.

Listed companies continually request extensions from the ZSE as their accounts are not ready to be published owing to the hassle of producing annual accounts in ZWL under inflation accounting.

Experts say this is not necessary because our local accounting firms cannot generate them, but rather because the accounts must be approved by South Africa’s technical departments, which have minimal experience with accounting for inflation.

Board chairman Kumbirai Katsande, in a statement accompanying the results said, the environment continued to be hyperinflationary and the cost of petrol and other necessities increased significantly.

Implementation of the previously stated US$25 million capital expansion program is continuing. The new Vertical Cement Mill (VCM) commissioning began in Q2 2022 after the automated Dry Mortars (DMO) Plant was successfully finished in 2021 and alternative power infrastructure was successfully installed in 2020. This is poised to increase the company’s profitability and revenue generation.

“Additionally, there is the refurbishment of silos which will help to increase the storage capacity of cement and to solve the dispatch bottle necks,” he said.

“These investments are expected to double the Company’s cement production capacity and improve raw material availability to the new DMO plant.”

The ongoing government-led infrastructure initiatives have created chances for company expansion. PPC and Lafarge Zimbabwe jointly own 70% of the local market.

“The overall market demand continues to grow driven by the individual home builders’ segment as well as the ongoing major Government infrastructure development projects,” he said.

Comparing the same period last year to this year, the amount of cement sold decreased by 56%.

The volumes from the dry mortar units decreased by 26% compared to the previous year since cement productivity is the key factor in DMO.

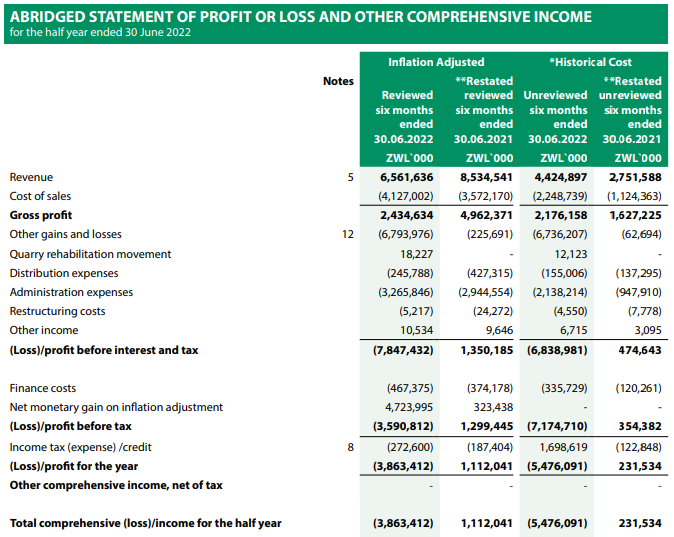

Cement volumes were negatively impacted by the decommissioning of cement mill 1 to create room for the VCM, the roof collapse of the mill building in Q4 2021, and the commissioning phase of the VCM. According to financials, inflation-adjusted revenue fell 23% to ZWL $6.6 billion in the first half of 2022.

The company turned to selling clinker, an intermediary product, to make ends meet, which resulted in a 21% decline in gross profit margin to 37.1%.

The company reported an operational loss of ZWL$7.8 billion, compared to a profit of ZWL$1.4 billion for the same period in 2021, as a consequence of a combination of lower sales income, tightened gross margins, greater operating costs, and an increase in foreign currency losses.

It did not declare an interim dividend.

It is optimistic that the government and business will continue to work together to foster macroeconomic stability, protect business confidence, and preserve value – Harare