By ETimes

Financial Performance Highlights

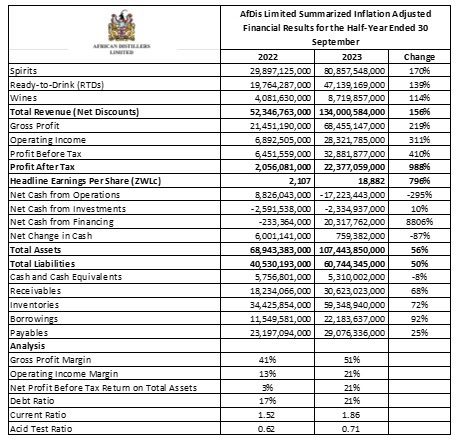

- ZSE listed AfDis posted an inflation adjusted net profit after tax of ZWL$22.4 billion for its half year ended 30 September 2023, representing a 988% rise from the comparative 2022 period

- Operating income increased by 311% to ZWL$28 billion, while gross profits surged 219% to ZWL$68.5 billion.

- The increased profits were supported by a 156% rise in total revenues, which hit ZWL$134 billion. This was attributed to growing volumes, a favourable sales mix, and replacement cost-based pricing. The group placed its USD revenue at US$25.7 million for the period.

- Among the company’s market segments, spirits showed the sharpest revenue growth at 170% to ZWL$80.9 billion as volumes increased by 8%, with firm demand on the affordable range. The RtD segment saw revenue growth of 139% to ZWL$47.1 billion following volume growth of 14% despite competition from lower priced smuggled imports. Revenue from wine sales increased by 114% to ZWL$8.7 billion as volumes increased by 7%.

- The company’s operations had a cash deficit of ZWL$17.2 billion for the period and net investment expenditures of ZWL$2.3 billion. This was offset by short-term borrowings raised during the period which saw the net cash increase by ZWL$759 million during the period.

- At the end of the period total assets stood at ZWL$107 million, with cash holdings of ZWL$5.3 billion, receivables of ZWL$30.6 billion and inventories of ZWL$59 billion. Total liabilities stood at ZWL$60.7 billion, with total borrowings of ZWL$22.2 billion and payables of ZWL$29 billion.

- Looking ahead the company will focus on maintaining a full range of supply to the market, identifying growth opportunities and improving profitability through product innovation, production efficiencies and cost control.

- A final dividend of US$0.0030 per share was declared for the half-year period.

Commentary and Analysis

On the face of it, it is a largely positive set of results for African Distilleries. The moderate growth in volumes across the board is notable, given the period under review falling under a tight liquidity environment. It appears that the company benefited significantly from the increased dollarization, which enhanced its capacity to maintain consistent supplies both to formal and informal markets. This increased forex business has also seen significant improvement in the company’s profitability and profit margins. Going forward, with a reasonably secure working capital position, the outlook for the company is stable. Increased dollarization of salaries and a relatively stable ZWL should drive further moderate volume growth in HY2. Although the ongoing power supply challenges present significant downside risk.

On the ZSE, since the start of 2023 the AfDis share has gained 659% in nominal terms and shed 9% in USD implied terms. The share is currently trading at a price to book ratio of 4.9x – Harare

Advertisement