By ETimes

Financial Performance Highlights

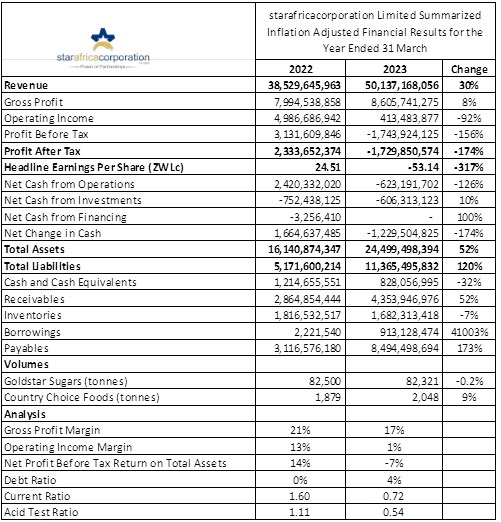

- Starafricacorporation Limited posted a ZWL$1.2 billion inflation adjusted after tax loss for its financial year ended 31 March 2023, a 174% decline from the 2022 comparative.

- Operating income declined by 92% to ZWL$413 million, while gross profit rose by 8% to ZWL$8.6 billion during the period.

- The group attributed the subdued performance to increasing raw sugar prices and operating costs in real terms – global inflationary pressures increased the cost of imported chemicals, packaging materials and equipment spares

- Total revenue increased by 30% to ZWL$50.1 billion, with the group noting strong demand for its products during the period.

- At 82,321 tonnes Goldstar sugar sales volumes were flat during the period as the group highlighted the adverse impact of the suspension of duty on sugar imports, and raw sugar stockouts and power outages.

- The Country Choice Foods segment saw volumes increase by 9% to 2,048 tonnes under improved capacity for the production of sugar specialties after the procurement and commissioning of syrup filling and icing packing machines. During the year the unit also launched new products; a drinking chocolate, powdered mahewu, baking powder, cocoa powder and baking raisins.

- The Tongaat Hullett Botswana associate recorded a profit of ZWL$958.1million during the year, with the group’s share being ZWL319.4 million.

- The group’s operations had a cash deficit of ZWL$623 million, which widened to an overall net deficit of ZWL$1.2 billion after net investment expenditures of ZWL$606 million.

- The groups total assets stood at ZWL$24.5 billion, with cash holdings of ZWL$828 million, receivables of ZWL$4.4 billion and inventories of ZWL$1.7 billion. Total liabilities stood at ZWL$11.4 billion, with borrowings of ZWL$913 million and payables of ZWL$8.5 billion.

- Looking ahead, the group looks forward to the government reinstating the import duty on imported sugar. It will also continue to tighten its cost-mitigation measures to improve profitability in both the refinery and sugar specialties unit. Efforts are ongoing to complete the refurbishment and replacement of critical plant and machinery to improve the output and efficiency of the refinery operations.

- The group did not declare a dividend.

Advertisement

Commentary and Analysis

Evidently, the volatile operating environment weighed heavily on the group as profit margins declined sharply. The other concern is the groups noticeably short working capital position and with the competitive pressure from imports, Starafricacorp’s situation appears tenuous. On the upside, the group boasts a fairly unique range of products in its Country Choice Foods unit, and the increased dollarization could be offering some respite in post-reporting period. The other upside is that the group did not tie itself to a significant and expensive debt load during the down period. So, it is possible that the group has weathered the storm in the period since the reporting date. In the long-term, the recent reports of the government’s plans to establish a new large scale sugar mill could be a boon for Starafrica – as the country’s only indigenously controlled refinery operation. The unit has faced significant setbacks in recent years and whilst it has generally been able to recover, its production levels remain below its pre-2010 peak. However, it is worth noting that the group’s main shareholder, the Takura 3 Fund, is primarily a PE investor, therefore it is possible that the group could be delisted and undergo restructuring at some point.

On the ZSE, since the start of 2023, the starafricacorp share has gained 134% in nominal terms and lost 72% in implied USD terms. The share is currently trading at a price to book ratio of 0.3x – Harare

Advertisement