By ETimes

Financial Performance Highlights

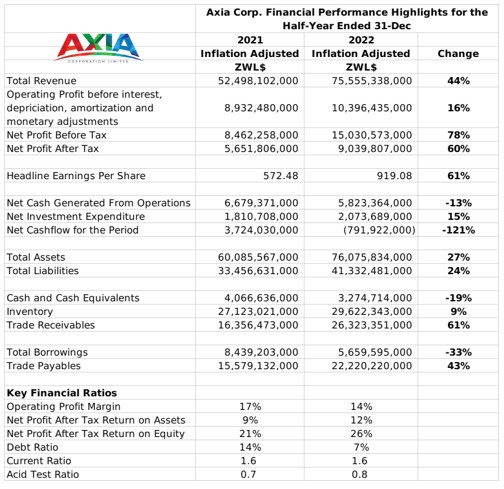

- VFEX listed retail group Axia Corp reported a ZWL$9 billion after tax profit for its half-year ended 31 December 2022, a 60% inflation adjusted rise from previous year comparative. The profit growth was supported by monetary gains of ZW$4.3 billion as growth in net operating profits was more subdued at 16% to ZWL$10.4 billion.

- The groups total revenues climbed 44% to ZWL$75.6 billion, with domestic sales rising by 27% to ZWL$64 billion and international sales rising by 69% to ZWL$14 billion.

- The group operations generated net cash flows of ZWL$5.8 billion, down 13% from the comparative period. Investment expenditure reached ZWL$2.1 billion and cash flows related to financing activities were -ZWL$4.5 billion.

- Total assets stood at ZWL$76.1 billion, with cash holdings of ZWL$3.3 billion, receivables of ZWL$29.6 billion and inventories of ZWL$26.3 billion. Total liabilities reached ZWL$41.3 billion, with payables of ZWL$22 billion and borrowings of ZWL$5.7 billion.

- The groups TV-Sales and Home segment reported Year-to-date volume group of 3%, which was attributed to weak sales in the first quarter brought on by restrictive pricing pressures. The group reported improved sales in the second quarter with the reintroduction of USD credit resulting in 382% group in the USD debtors’ group. Raw material supply challenges resulting from auction delays resulted in 20% and 15% volume declines in the Restapedic and lounge-suite manufacturing divisions. The segment opened two new stores in Harare during the half-year and expects to open at least three new stores including “Bedtime Store” – a new store concept specializing in homeware and appliances. The group expects its Sunway City bedding factory to open in March 2023, and reported progress in the export market for lounge suites.

- The Distribution Group Africa (DGA) Zimbabwe segment reported a 27% comparative decline in volumes, due to weaker demand in the informal markets and the strategic decision to reduce credit risk by stopping supplies to some customers. However, the operation remained profitable through cost containment efforts and an aggressive repayment of debt programme.

- The DGA regional business saw mixed performances in its markets with 5% volume growth in Zambia and an 8% rise in operating profits in USD terms. Meanwhile the Malawi business saw volumes decline by 25% due to foreign currency challenges, however expenditure containment kept the operation profitable.

- The Transerv segment saw its revenue decline by 3% from the comparative period which was attributed to restrictive pricing challenges in the first two months of period. The segment opened two new storefronts in Harare, and the group reported plans to open a further six shows in the 2023 financial year.

- Looking ahead, the Group’s management teams will focus on managing debt and costs, exploiting market opportunities, balancing pricing and volume objectives, achieving appropriate levels of margin return, and ensuring maximum free cash generation.

- The group declared an interim dividend of US$0.0018 per share payable to shareholders registered on the 21st April 2023.

Commentary and Analysis

It is a fair set of financial results in an economy not configured to support high-value credit-oriented retail – with its low formal employment, continuously depressed consumer purchasing power and prohibitively high borrowing rates. The low growth of the groups local sales compared to the foreign sales is suggestive of a depressed consumer environment. So, it’s a positive that the group was able to generate enough net operating cash-flows to sustainably repay its debts and invest in expansion. In the short to medium term, easing the interest burden would have been important for managing global and local cost inflation pressures against the diminished consumer capacity. Overall, with significant cash holdings and internal capacity to generate cash, the group presently looks financially stable. Although. the elevated credit risk from the USD debtors’ book is a slight concern under the rising economic and political volatility. Another concern is the effect of the country’s ongoing power supply shortages on the manufacturing operations and the competitiveness of the output in the targeted export markets. Otherwise, looking long-term, the group is well placed to be the dominant presence in the local formal retail market for household wares and appliances. The current economic configuration is unlikely to support or attract another big player in the market, and Axia stands to have a significant head start when/if conditions become more accommodating. In the meantime, an increased emphasis on the group’s regional businesses would be ideal and in alignment with the migration to the VFEX.

On the VFEX, the Axia share is currently trading at USc13.5, with an implied YTD return of 5% and a price to book ratio of 2.5x – Harare

Place your advert at affordable rates